Ethereum (ETH) prices are stuck between $3,100 and $3,200. This makes buyers wonder if they should change their ETH plans before May. There have been changes in the market and regulatory noise that makes it seem like it might be time for a reevaluation.

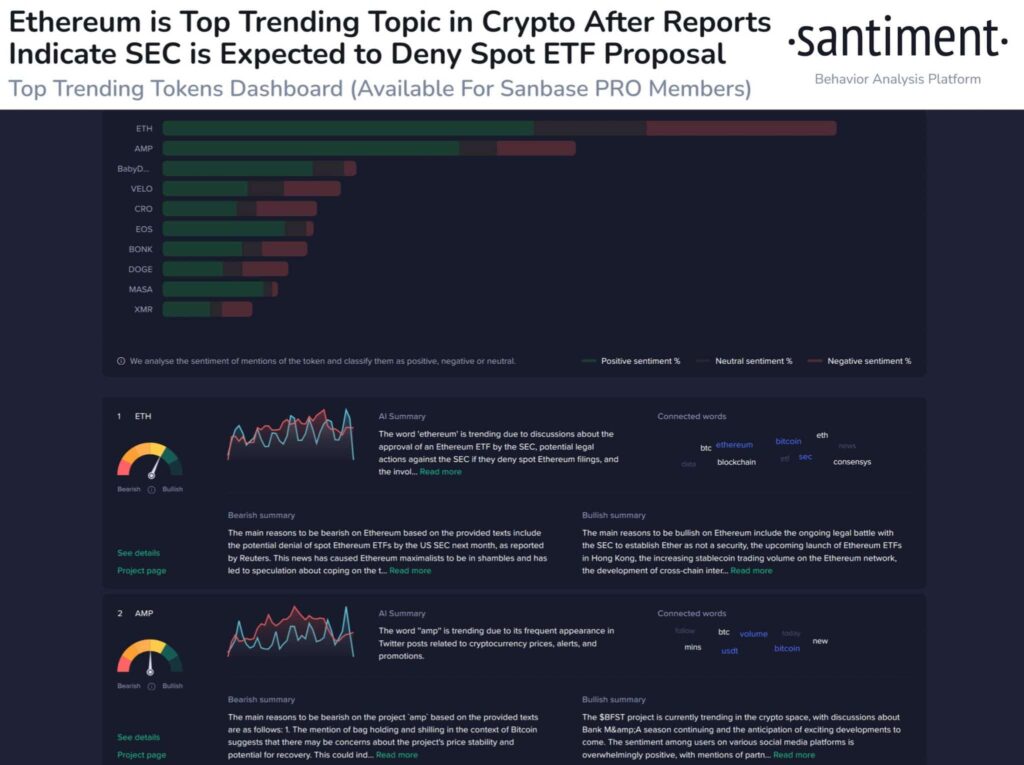

Even though Ethereum crashed not long ago, there has been a lot more social activity on it. But below the surface, there is a story of mixed emotions going on. Traders are talking a lot about how the SEC could turn down plans for a spot Ethereum ETF in May.

The community’s confidence, which mostly came from the fact that spot Bitcoin ETFs were approved earlier in January, might be dashed. There are signs that the SEC might not give the same permission to other investments, at least not soon.

Ethereum’s FUD Opportunity

In a strange way, this doubt could help assets that aren’t Bitcoin, since market moves in the past have often been different from what people expected.

The recent drop in Bitcoin’s value from its all-time high has caused traders to feel more fear, uncertainty, and doubt (FUD). This could be good for alternative investments. As negative feelings get stronger, relief bounces may be on the way, giving smart investors chances to make money.

Still, being careful is the most important thing, even with all this question. In the short term, ETH could go up if regulators take a softer attitude or if an unexpected approval comes through. However, traders’ stress and fear of missing out (FOMO) are also significant risks. Because people are so excited, prices might drop for a short time, which is good for whales.

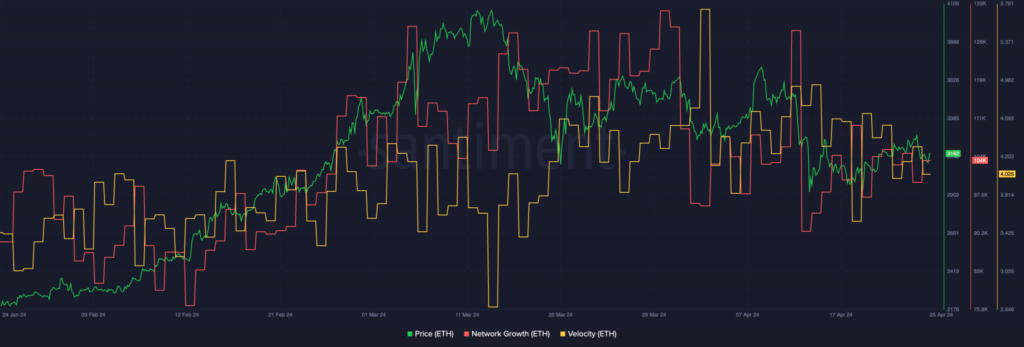

Yes, there is an old proverb that goes “buy the rumor, sell the news.” Right now, ETH is worth $3,151.30, which is 0.35% less than it was 24 hours ago. The network has also slowed down and growth has slowed down. In the short run, this makes things look terrible.