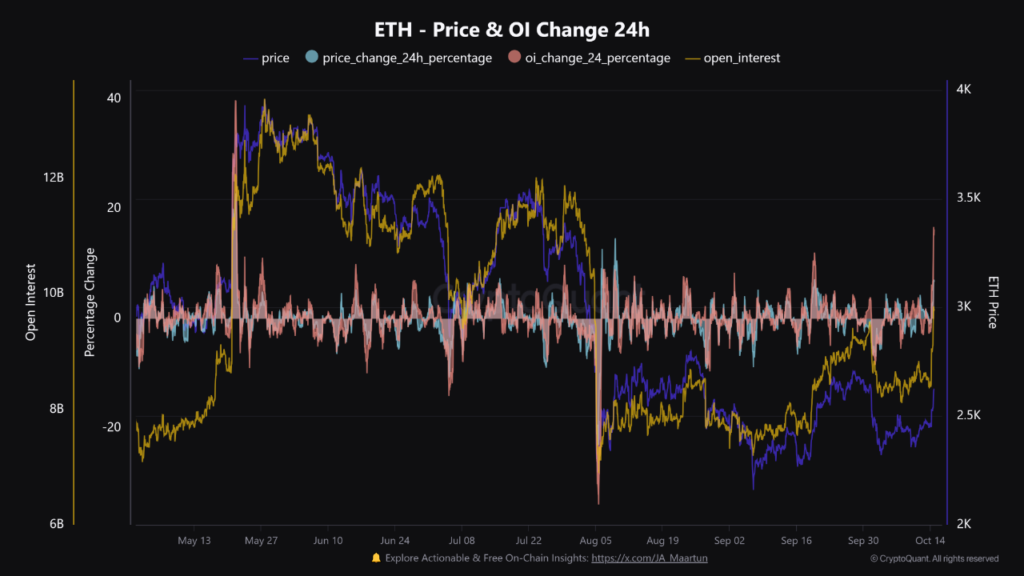

It has been noted that the Ethereum Open Interest is increasing at its highest level in the past five months, which may result in price volatility of the coin.

There are recent price spiking in Ethereum token related derivatives platforms noticed by a CryptoQuant analyst, and this obviously indicates a spike in Open Interest, which tracks the number of ETH related positions taken across such operations.

This type of rise usually means new leverage in the market, and increase price swings are more probable. This means traders are coming into the market and opening new positions, usually with leverage.

Ethereum Market Instability Risks Rise

The inflow from heightened leverage can actually exacerbate the market instability, as such sudden price shifts could trigger mass liquidations (‘sell offs’, or a ‘squeeze’), perhaps even cleansing the market of concentrated funds. By contrast, a decrease in Open Interest means traders are closing positions and prices may stabilize.

During their price recovery, the recent data shows that Ethereum’s Open Interest has soared to surpass the September levels. It was the last time such a large 24 hour rise occurred, in May. Rallies typically draw speculation but the magnitude of the current rise of its rate has raised fears of volatility.

The analyst said funding rates, which are a measure of the balance between long and short positions, are elevated. This indicates that the market is ‘long heavy’, that is too many traders are betting that Ethereum’s price will go up. This has historically resulted in long squeezes, where when leveraged longs are forced to close their positions rapidly due to an unexpected price drop, it will plummet even further.

The leading cryptocurrency Ethereum is currently $2,600 and has gained over 8 percent in the past week. When it actually happens, we’ll see how the market responds to this increased leverage and traders will have to brace for wild moves in either direction.