In recent news about the Grayscale Bitcoin Trust (GBTC), there was a drop in withdrawals that was so low that it shocked market experts. When US inflation figures came out, Bitcoin’s value went up. This made the crypto market less stable. This drop, which was almost 90% less than the day before, took place all at once.

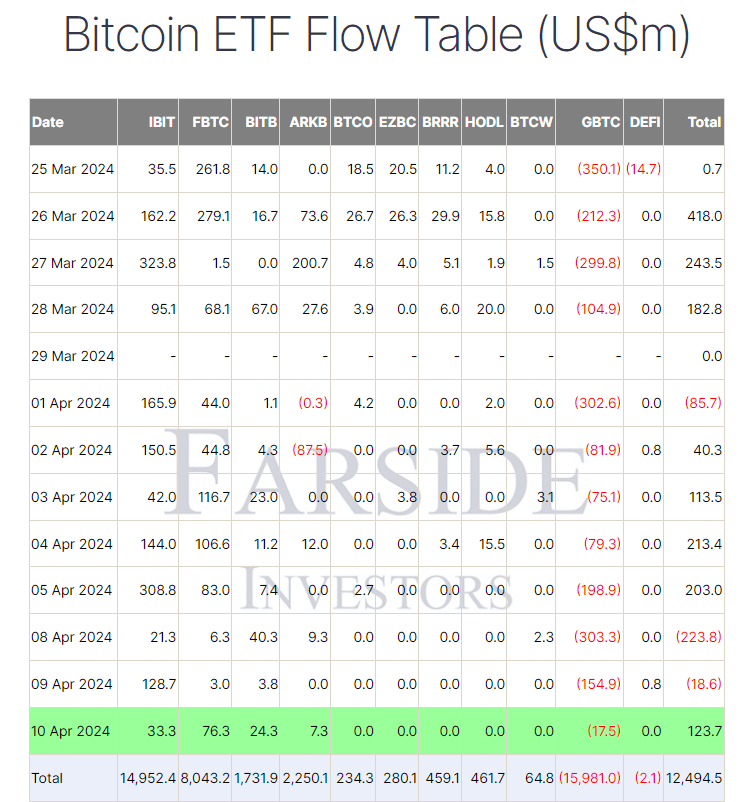

According to figures from Farside, GBTC lost only $17.5 million on April 10. This is a big drop from the day before when it lost a huge $154.9 million.

GBTC Boosts Bitcoin’s Price Amid Economic Data Concerns

This made Bitcoin’s price rise 2.08% in the last 24 hours to $70,542. It was more surprising than anyone thought when the March U.S. Consumer Price Index (CPI) report showed a 3.5% rise from the previous year. People feared that the U.S. Federal Reserve might have to delay lowering interest rates. This caused a drop to a local low of $67,482.

Since it became a spot Bitcoin ETF in January, $16 billion less has been leaving the GBTC fund. People in the business world are cautiously hopeful because of this. CEO of cryptocurrency review site Apollo, Thomas Fahrer, said that withdrawals have dropped significantly. This could mean that the market mood is changing.

Several reports say that trades in BlackRock IBIT, Fidelity FBTC, ARK’s ARKB, and Bitwise BITB Bitcoin exchange-traded funds (ETFs) on April 10 all went up by a small amount. FBTC got $76.3 million today, the most money it has had since April 5. This makes it $8,043.2 billion altogether. Coin ETFs are now worth $12,494.5 billion more than they were before.

People in the business world are also talking about the thought of Bitcoin being cut in half on April 20. This event will decrease the number of Bitcoin blocks from 6.25 coins per block to 3.125 coins per block. Because the quantity is growing less quickly, Bitcoin has been more expensive in the past.

Fred Thiel, CEO of Bitcoin mining company Marathon Digital, told Bloomberg that the recent approval of spot Bitcoin ETFs has brought a lot of money into the market. This could speed up the rise of the market after the split.

People are getting excited about the market because of spot Bitcoin ETFs. This means there are high hopes for more demand, which could lead to even more price rises. Even though the amount will be cut in half after the halving, Andras Kristof, CEO and co-founder of Galaxis, discussed how this rise in demand could affect the price and security of Bitcoin.

The price of Bitcoin went up a lot before it was cut in half. But market experts think it will stay strong because more people want to buy, especially large investors who don’t want to miss out.

Cryptocurrency prices will continue to fluctuate for a long time. Two signs are the excitement about halving Bitcoin and the flow of funds from spot Bitcoin ETFs. Prices will go through the roof, and this kind of market chaos will likely happen again.