Grayscale’s place A lot of funds left the Bitcoin ETF in the hours before the much-anticipated split event. This is a regular code change that is meant to keep BTC scarce.

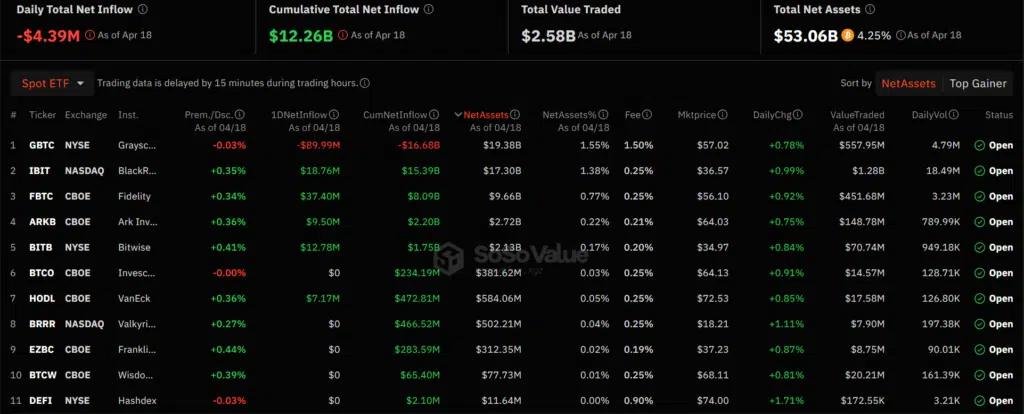

According to data gathered by SoSoValue, Grayscale saw huge outflows of $89.9 million. This was the fifth day funds left the platform, bringing the total net outflows from GBTC to $1.6 billion since it started in January.

Grayscale’s Competitors Fidelity and BlackRock’s Performance in Spot Bitcoin ETFs

The total amount of funds that left the 10 spot Bitcoin (BTC) ETFs over the past year was $4.3 million. While Grayscale had to deal with many liquidations, rivals like Fidelity and BlackRock could take advantage of demand and help GBTC recover some of its losses.

BlackRock’s IBIT had net inflows of $18.7 million, but Fidelity’s FBTC had net inflows of $37.3 million. On April 18, BlackRock lagged behind a competitor in spot BTC ETF inflows, which rarely happens.

Even though it started as the major spot Bitcoin ETF because it had been around for ten years, GBTC has lost a lot of market share to younger companies like BlackRock.

Reports say that GBTC’s assets under management (AUM) have dropped by about 50% in just four months of trade. Grayscale currently has an AUM of less than $20 billion, while BlackRock has over $17 billion in investor demand.

Experts in the field, like Eric Balchunas of Bloomberg, say that the large GBTC outflows are due to current legal cases involving companies like FTX and Genesis. Some observers also say that Grayscale’s relatively high fund fee of 1.5% played a role in the liquidations.

Because of these problems, Michael Sonnenshein, CEO of Grayscale, said that GBTC fees would be lowered gradually over time. The company also wants to bring out a Bitcoin Mini Trust ETF with lower fees to boost demand and regain the lost market share.