Litecoin (LTC) now has more than five million long-term users. This is a significant milestone that could cause a major shift in the cryptocurrency market. IntoTheBlock data shows that this milestone is reached by about 62.5% of all LTC accounts that have a balance.

This proves that Litecoin is still interesting to a lot of people in the crypto world.LTC buyers have been on the rise, and this trend has been especially clear in the last few months.

It shows that more and more investors are choosing to hold on to LTC for a long time. In February, there were 170,000 more long-term buyers, which is a major difference. This shows that investors are very sure that Litecoin will do well in the long run.

Litecoin (LTC) Long-Term Holders Surge

Along with the rise in long-term holders, the number of people who have held LTC for more than a year has slowly grown and now stands at 2.54 million addresses. Aside from the gain in value, another reason to hold LTC for a long time is that it can be profitable.

The blockchain shows that 49.76 million LTC are held in 67.67% of all LTC accounts that are currently making money. Other than that, about 26.8% of LTC holders, or 2.15 million addresses, are losing funds right now. 5.53 percent of buyers are in this group, which keeps the price close to the point where it breaks even.

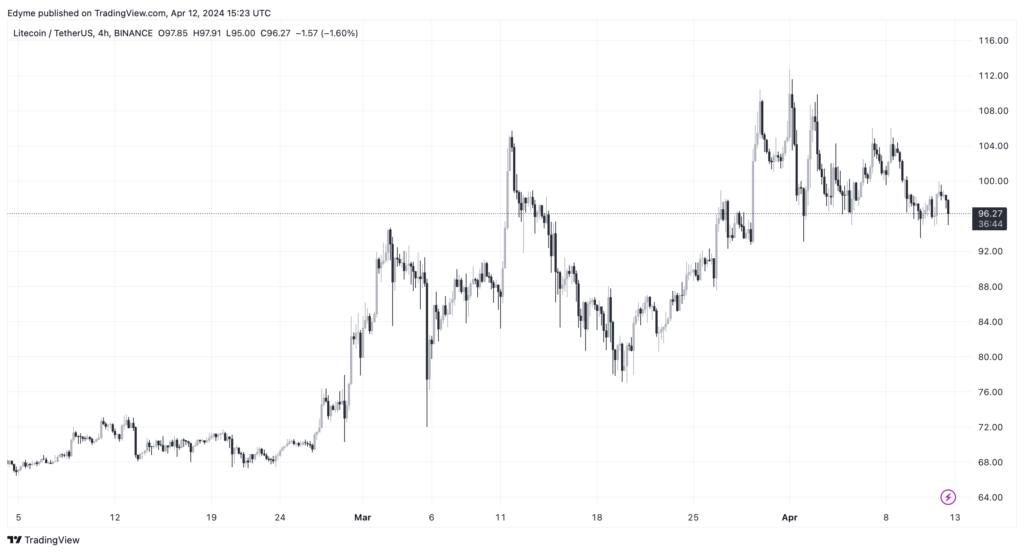

Litecoin’s price has been pretty stable lately, with a small rise of 0.3% in the last week and a small drop of 0.1% in the last 24 hours. However, experts think that the price could start to rise again in the coming months. The price is expected to rise to $400, thanks to increased interest from institutions and rumors about a possible Litecoin Exchange-Traded Fund (ETF).

Eleanor Terrett, a reporter for Fox Business, said that institutions might be interested in a Litecoin ETF. She said that the fact that LTC works similarly to Bitcoin could help the US Securities and Exchange Commission (SEC) decide to approve it.

People are even more excited about Litecoin now that Coinbase Derivatives has started to offer futures contracts for it. A well-known crypto analyst named Luke Martin says that if an Ethereum ETF is allowed, it might be easier for “old altcoins” like Litecoin to get legal approval because they might be put in a different category than Ethereum.