The highly-anticipated cryptocurrency Notcoin [NOT], which is based on Telegram, finally made its grand entrance on May 16th. However, the launch was not without flaws. Investors held their breath as the new company stumbled out of the gate and saw its price drop significantly just hours after its well-publicized start.

Notcoin’s early promise was quickly overshadowed by a hard reality check. Its value was set at $0.01 and its market capitalization soared to $1 billion. CoinMarketCap data shows that NOT’s price dropped by more than 53% after it launched. It is now traded at $0.006631 and is ranked 108th among cryptocurrencies by market cap.

Notcoin’s (NOT) Impressive Trading Volume

Significant drops in value after airdrops have happened before, but these events are still a stark reminder of how volatile the crypto market is. A lot of the time, these sharp drops are blamed on the large number of sell-offs by investors looking to make currency right after the start.

But despite all the chaos, Notcoin was able to keep up a high trading volume. It reached $1.4 billion in the first 24 hours of trading, making it the eighth most regularly traded cryptocurrency.

Surprisingly, the top exchange Binance said it would be taking down the NOT/BTC trade pair, which was supposed to be added on May 16th. The move was explained as an attempt to improve dealing in general, but it definitely made it less clear where Notcoin will go in the future.

At the same time, Toncoin [TON], the system that supports Notcoin, had its own problems. Notcoin’s upcoming start caused a lot of excitement at first, but Toncoin’s luck turned bad, and its price dropped by over 3% in just the last week.

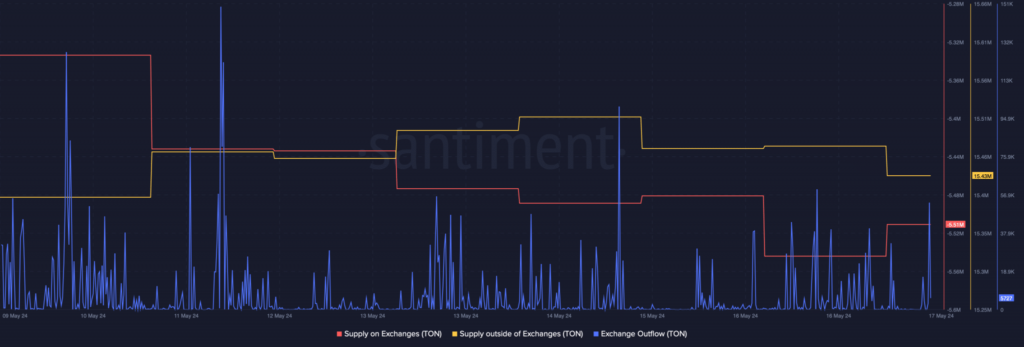

But buyers with eyes open jumped at the chance to buy TON at lower prices. This is shown by the fact that the supply of TON on exchanges dropped sharply while its supply rose outside of exchanges. The sharp rise in exchange withdrawals showed that there was a lot of buying pressure around Toncoin.

Even though the accumulation trend is positive, technical signs point to a cautious outlook for the price of TON. Santiment’s research showed that the token’s Chaikin Money Flow (CMF) was going down, which means that prices could go down even more. TON’s price is also still above its 20-day simple moving average (SMA), which means it’s likely to fall to this support level before going up again.