People often say that “what goes up must come down” in the fast-paced world of cryptocurrency. This is the case with PENDLE, the token whose value has grown very quickly over the past month, making all of its buyers happy at first.

Recent data from CoinMarketCap shows that PENDLE’s value went through the roof by a remarkable 119%, which made investors very happy.

Another incredible finding I found when I looked at IntoTheBlock’s data was that every single PENDLE investor made a lot of funds. At first glance, everything looked great. The market was generally positive

PENDLE’s Precarious Position Whales Trigger Sell-Off Frenzy

There is a saying that says “all that glitters is not gold.” There were scary signs going on behind the scenes. Many people paid attention to what Lookonchain saw when he said that a whale named HashKey started a massive sell-off. This whale, which is known for its smart moves, sent a huge 500,000 PENDLE to Binance, which is worth a remarkable $3.54 million. Someone did something that shocked the market.

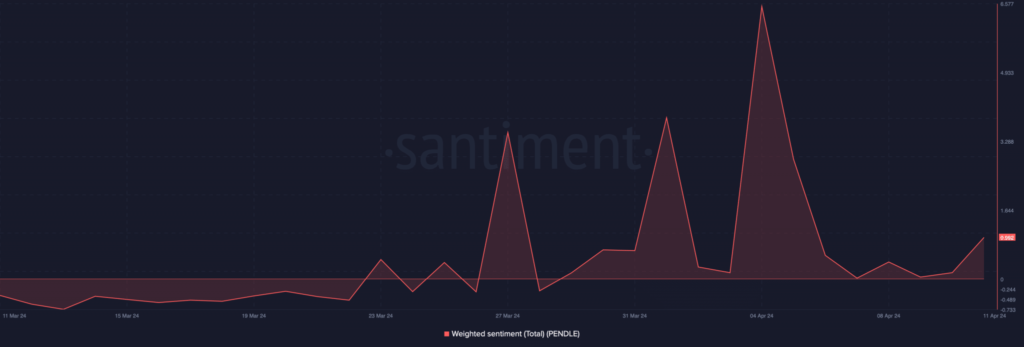

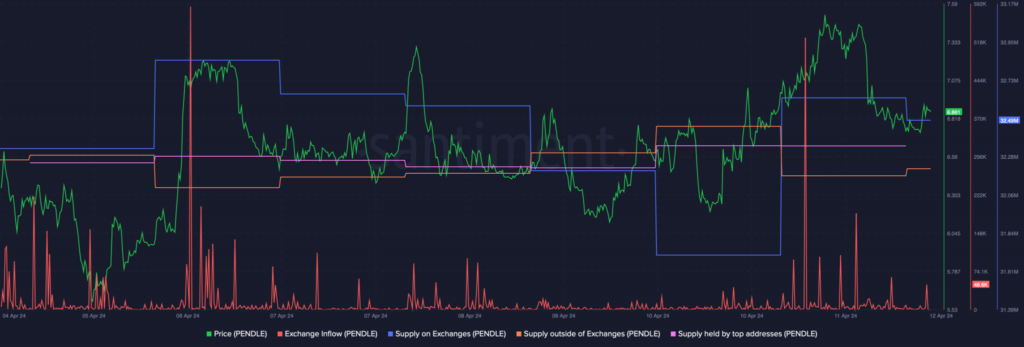

Using Santiment’s data for more research, it was found that there was a rise in selling pressure right when PENDLE’s price went up. It was clear that the whales were getting out, and they weren’t the only ones. The token’s exchange inflow sped up, which showed that buyers were selling a lot of tokens.

Even though everyone was going crazy, whales kept playing their game and collecting PENDLE like nothing had changed. Their behaviors told us a lot about their long-term plan that didn’t change based on short-term changes.

The results were terrible for the regular investor, which was a shame. Because of these events, the price of PENDLE fell sharply, dropping more than 5% in just the last 24 hours. Its market value is now over $1.6 billion, and it’s trading at $6.69.

Analyst looked at the basic analysis to get a better idea of what was coming next. The picture they saw was scary. PENDLE’s price was stuck near the upper limit of the Bollinger Bands, and signs like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) pointed to a downward trend that was about to start.