Investors continue to take notice of Bitcoin’s steady climb toward new all time highs as it pierces spiking resistance levels. At this rate of growth, a recent analysis by CryptoQuant analyst TraderOasis looks into the asset’s path forward.

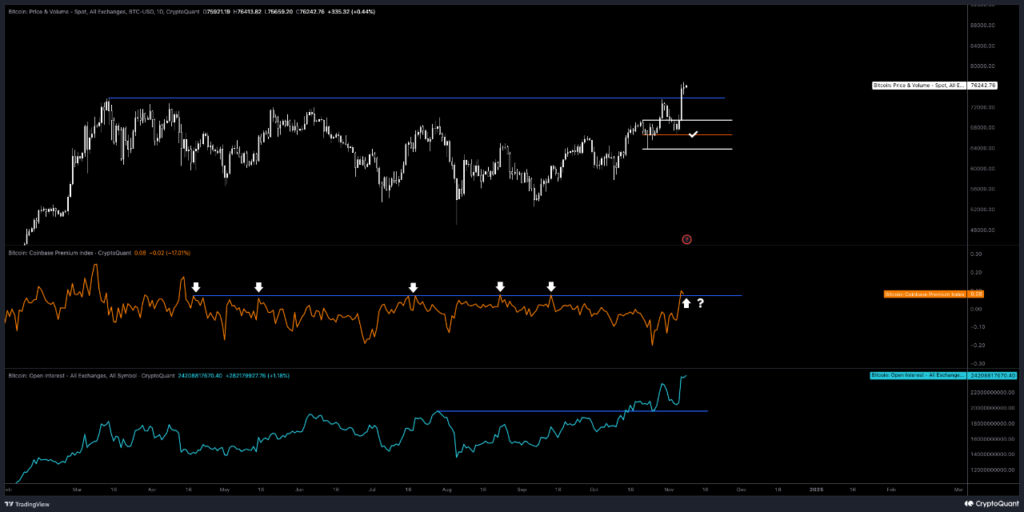

Bitcoin’s past all time high (ATH) could now act as a support level, according to TraderOasis, underpinning the current rally. This is a key level (as noted on a blue line in his chart), indicating bitcoin’s next move. He also flagged another positive sign the Coinbase Premium Index which shows buying demand for tokens on Coinbase relative to the rest of the market.

Bitcoin Market Shows Stability

After the positive shift for the index, price began to rise, which put Bitcoin into a critical resistance zone to keep its price moving in an upward trend. Bitcoin is starting to climb along with other assets, But he added that although open interest, or outstanding derivative contracts is rising alongside Bitcoin’s price, the strong market engagement observed does not show signs of instability or excessive leverage.

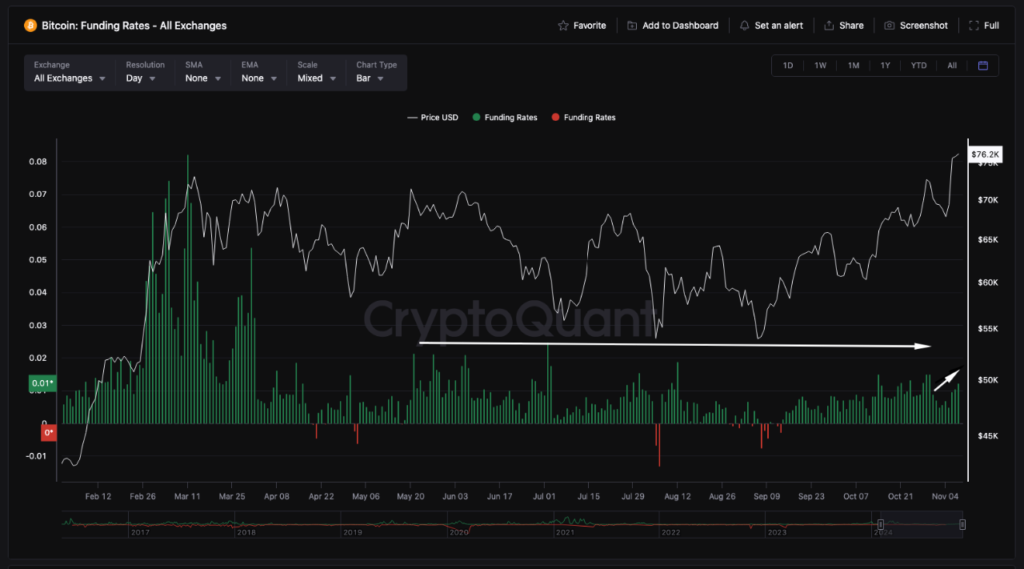

BTC rising funding rates were one of TraderOasis’s key points, a metric showing how much the cost of holding long positions on perpetual futures contracts have been going up. He notes that, in fact, these rates are ticking up, and that it is a sign that market confidence is picking up. But he warned that if many funding rates rise too quickly, it could imply an overbought market on its way to a correction.

The analyst also pointed out a second indicator the exchange netflow, which counts in and out of money on bitcoin spot exchanges. Recent netflow spikes could indicate a potential sell off, says Oasis, and this could be leading us to some imminent volatility. Netflow spikes historically have followed sentiment shifts and price swings, so traders may consider taking profits to manage risk, he advised.

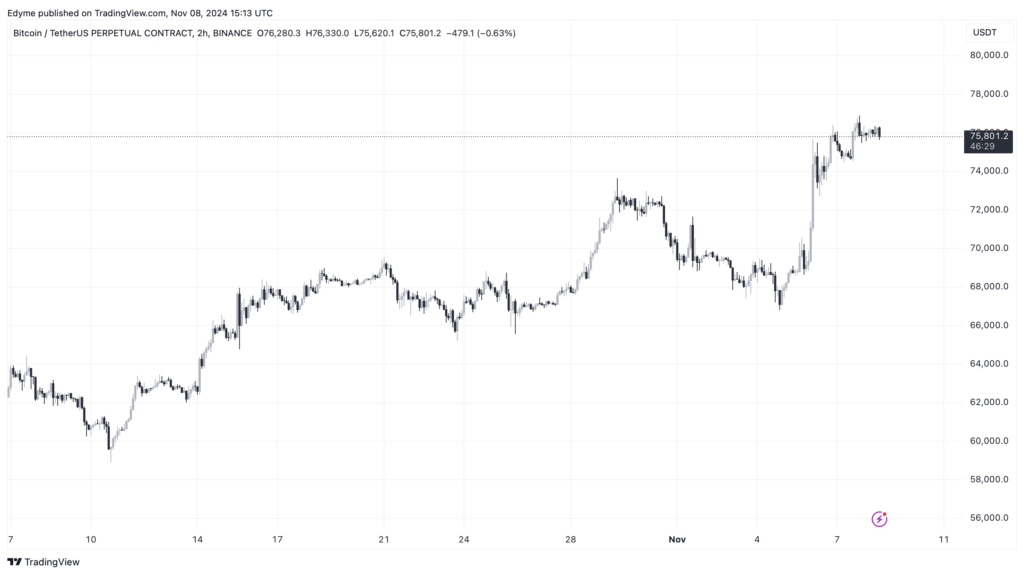

Following BTC recent ATH of $76,872, Bitcoin has stabilized at $75,820, up 0.9% over the past 24 hours. While BTC holds steady above $75,000, the market now sits on its watch for these indicators to give the green light on whether or not the rally is continuing or that a pullback is coming soon.