Ryan Sean Adams, a prominent investor, podcaster, and crypto educator with a lot of experience with Ethereum (ETH), recently wrote on X about two different ways he sees the future of Ether (ETH) as a coin.

Adams says that buyers might not pay attention to Ethereum (ETH) during a possible rally in 2024–2025 because it is going through what he calls an “awkward” phase similar to “puberty.” He agrees that ETH seems slow and expensive when compared to its second-layer options, which are different in type.

Adams says that second-layer solutions may not always get the attention of the most clear investors, even though they are important for the scalability of Ethereum’s blockchain and are in line with the founder’s vision of progress.

People who like meme coins and people who use decentralized apps (dApps), like those who take part in retroactive airdrop schemes, are more likely to be interested in second- and third-layer blockchains. On the other hand, major investors seem to like Bitcoin (BTC).

Ethereum’s ETF Potential Impact

Spot Ether Exchange-Traded Funds (ETFs) could change this situation if they are approved in the US, but experts are still not sure if this will happen soon. As a result, Ethereum (ETH) is dealing with the difficulties of its “puberty” phase, while new “toddler chains” may seem more appealing in the medium term because they seem to offer faster solutions.

At the same time, as of Q2 2024, the reasons in favor of Ethereum’s optimism look strong. The platform is stronger than it was in 2020, thanks to second-layer solutions that work but may be overhyped and zkEVMs (zero-knowledge Ethereum Virtual Machines) that encourage new ideas and bring in value.

Also, Ethereum’s “rock solid monetary economics,” which was strengthened by the adoption of ERC 4337, makes it even more clear that it is the only blockchain that can generate funds, with all of its competitors falling far behind.

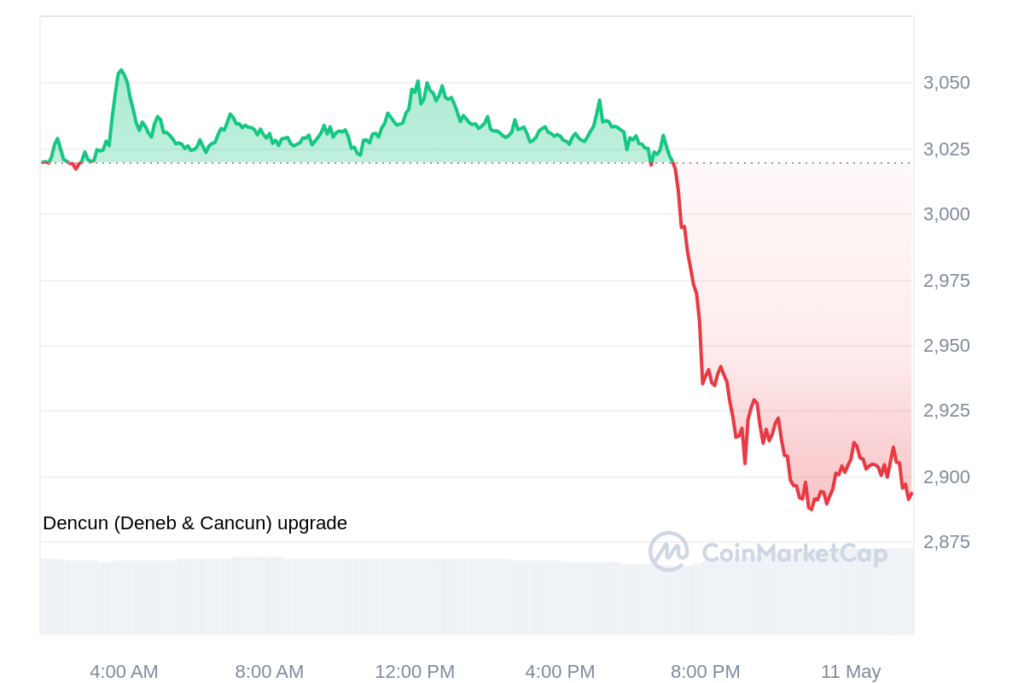

Adams says that even though other blockchains are becoming more famous, Ethereum’s mainnet is still the base chain for more than 1,000 blockchains. According to the author, these two different points of view are just two sides of the same coin for people who are bullish on ETH. Ether (ETH) is selling at $2,925 at the time of this report, down 3% in the last 24 hours.