Investors are now looking at Solana, the second-largest altcoin, after Ethereum ETFs hit Wall Street. VanEck, a major name in asset management, has hinted that it might start a spot for Solana ETF, which has crypto fans excited.

In a tweet while the Bitcoin Conference was still going on, VanEck said that many people there were interested in Solana. VanEck filed for the SOL ETF last month, ahead of the launch of Ethereum ETFs.

The tweet suggests that there is a lot of interest in SOL and that worries about liquidity might not slow down the SEC’s approval process.

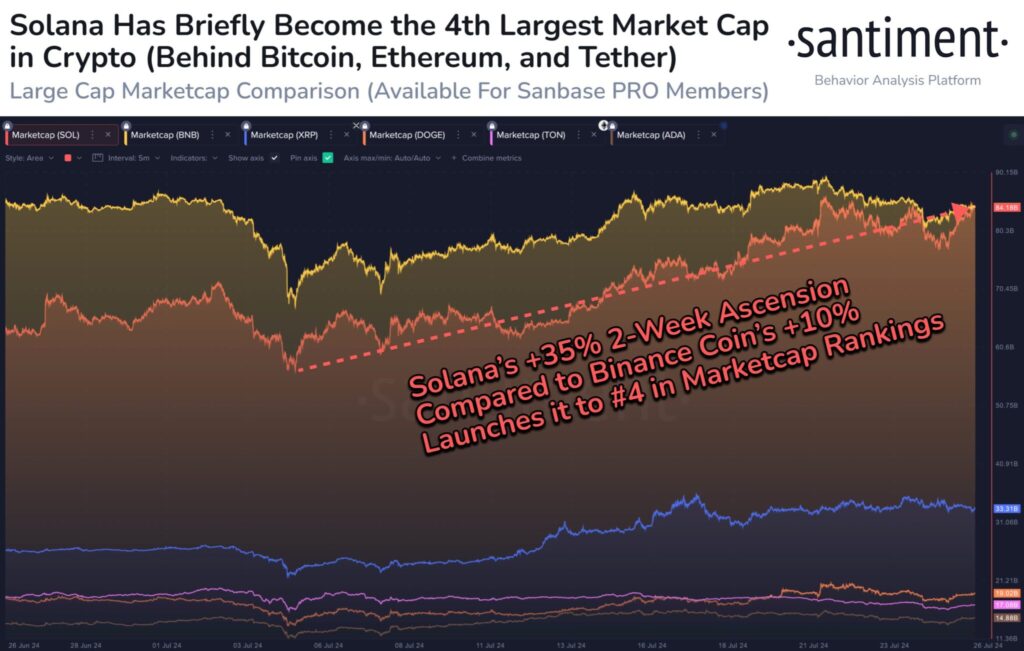

Solana Surpasses Binance Coin

Meanwhile, the availability of crypto ETFs has not instilled optimism in all asset management companies. Robert Mitchnick, who is the head of digital assets at BlackRock, was skeptical at the meeting. He said that besides Ethereum, all the other altcoins make up less than 5% of the total crypto market cap. This made him question why there is a need for more crypto ETFs.

Solana (SOL) has passed Binance Coin (BNB) to become the fourth-largest cryptocurrency by market cap. This is the first time it has happened in four years. Solana’s price has gone up by more than 35% in the last two weeks, while Binance Coin’s cost has gone up by 10%.

The most recent price for SOL is $182, which is up 3.88 percent. The price of $175 is a strong support level. Rekt Capital, a well-known crypto analyst, said that SOL has strong technical support and could hit $202 because its total value locked (TVL) rose by 15% this month.

With VanEck’s possible Solana ETF and the cryptocurrency’s strong market performance, the altcoin is getting a lot of attention. This sets the stage for more changes in the crypto ETF landscape.