Zeus Network’s plans to connect Solana to the Bitcoin blockchain have raised bullish momentum for the cryptocurrency Solana (SOL).

The price of SOL has risen by 4% in the last 24 hours to $129. The coin’s value has reached over $58 billion, and $4.1 billion worth of transactions occur every day.

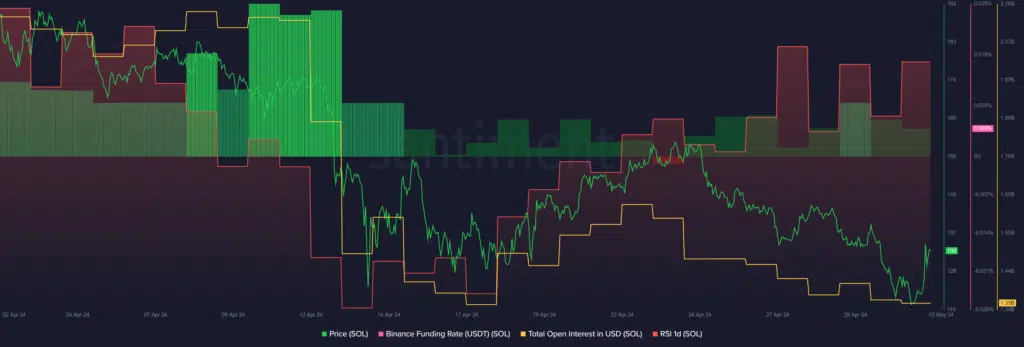

According to Santiment’s analysis, SOL’s total open interest has decreased steadily over the last 10 days, going from $1.63 billion on April 22 to $1.35 billion when posting. This drop in open interest could mean prices aren’t changing as much, and people are selling their stocks.

Also, Santiment’s market intelligence tool shows that the number of long-to-short trades on Binance has been cut in half since April 29, when SOL started decreasing. This means more trade contracts are being made to bet against rising prices.

Solana Relative Strength Index (RSI) Analysis: Implications for Market Trends

In the past 24 hours, the SOL Relative Strength Index (RSI) has gone from 43 to 50. This means the asset is neither undervalued nor overvalued based on the present market conditions. However, SOL’s RSI must stay below 50 to keep its upward trend. An RSI value above 50 could mean that prices are more likely to change quickly and that big buyers might try to manipulate them.

People feel good about SOL after Zeus Network said they might add Solana as a Layer 2 solution for all blockchains that use ZPL (Zeus Program Library) and assets that can communicate without approval.

The announcement says this integration could let people convert assets like Bitcoin into ZPL assets like zBTC, giving them access to the Solana ecosystem.