Solana (SOL) finds itself at a crossroads with hazy direction. Once a major participant in the 2023 bitcoin frenzy, SOL’s value has stagnated and trading inside the limited band of $155 to $170 for the past few days leaves investors both hopeful yet perplexed.

For this fast blockchain system, technical signs offer a mixed picture. The menacing “death cross,” which denotes a temporary price decline, has surfaced as the 50-day moving average fell below the 200-day average. The Relative Strength Index (RSI) stays neutral, nevertheless, implying underlying but weak buying demand.

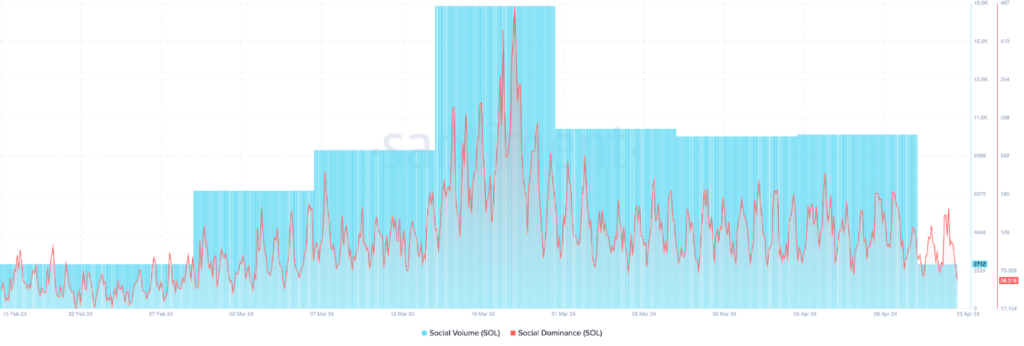

Solana’s buzz on social media has faded; few mentions and debates point to a public interest reduction. Furthermore, trading activity has dropped by more than half, which reflects less community involvement.

Solana’s Uncertain Trajectory Puzzles Investors

Though there is still much unknown, flashes of hope show through. Examination of the derivatives market exposes an interesting dynamic. Although the long/short ratio shows investor uncertainty generally, prominent exchanges like Binance and OKX exhibit a more positive attitude with higher long positions.

Furthermore, recent price swings have set off short liquidations, maybe driving out pessimistic traders and opening the path for a temporary surge. This emphasizes how erratic the crypto market is by nature, where unexpected upward momentum may surprise pessimists.

Forecasts from analysts ahead differ. Some, like CoinCodex, see a hopeful spike to $185 by July 10th. This optimism, however, runs counter to bearish technical signals and a “greed” value on the Fear and Greed Index, therefore suggesting perhaps overvaluation.

Future of Solana depends on several elements. Its course could be greatly changed by outside influences like more general market movements and government policies. Furthermore, the success of forthcoming Solana blockchain initiatives can inspire investor interest and propel token value further.