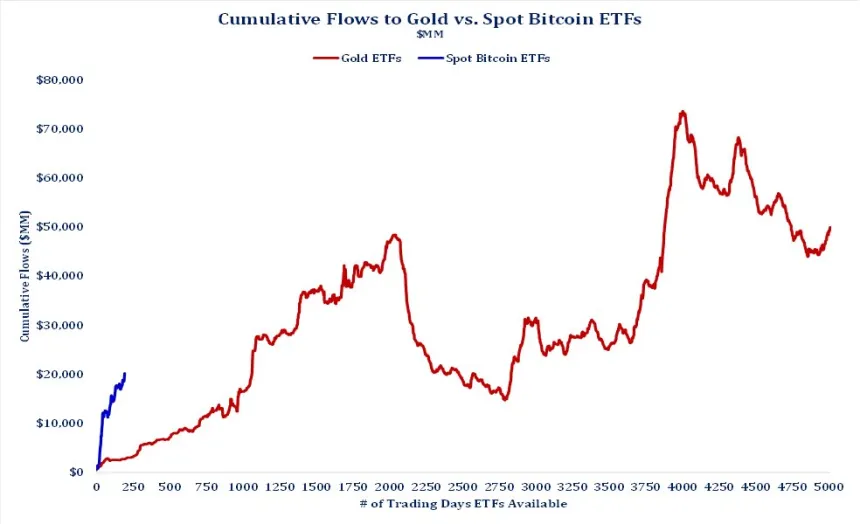

Presumably, ETF Store President Nate Geraci sees U.S.-based spot Bitcoin ETFs supplanting Gold ETFs in cumulative net inflows. Following an astonishing week for Bitcoin ETFs, which pulled in more than $2 billion in net flows, his projection is understandable.

Weekly net flows in spot Bitcoin ETFs that have been launched so far stood at $2.13 billion as Bitcoin surges +9.23 percent on the eve of a crypto spring, reaching the $70,000 resistance level. But Geraci says he believes in the next two years, spot Bitcoin ETFs will see more net flows than Gold ETFs. Still, this forecast is faster than 18 years of Gold ETF inflow to $55 billion versus $20.66 billion in a year for BTC ETFs.

Bitcoin ETFs Reach $65 Billion

Spot BTC ETFs have now attracted $65 billion in total net assets, extending a milestone that Gold ETFs passed nearly five years ago, said Bloomberg analyst Eric Balchunas. Additionally, there are barely 11 spot BTC ETFs tradable at present, against almost 5,000 global gold ETFs, meaning BTC ETFs could soon start to significantly outnumber gold ETFs as digital asset usage grows and with the possibility of a crypto market bull run.

However, crypto analyst Ali Martinez said BTC could fall in to a ‘short term dip’ following its price rally. BTC rose above $69,000, after adding over 8%, and Martinez, however, pointed out a sell signal on the TD Sequential indicator and a bearish divergence on the Relative Strength Index (RSI). BTC next support level is around $60,000 if the downturn does happen, but stronger selling pressure could bear out to $55,000.