Stablecoins are reliable during the volatile crypto market. They differ from cryptocurrencies like Bitcoin and Ethereum. They are tied to stable assets, like fiat money or commodities.

Here comes the Tether (USDT), ranked third among all cryptocurrencies. It has significant influence and utility and is the most used stablecoin in crypto.

This article will examine Tether, its uses, how it works, and recent advancements that have increased its visibility in crypto. By the conclusion, you will fully grasp the basic knowledge and reasons Tether is so important in the crypto market.

What is Tether?

Tether (USDT) is a fiat-collateralized stablecoin supported by fiat currencies such as USD, CAD, AUD, or JPY. It is designed to keep a constant value by balancing its market price. USDT appeals to investors who want to reduce the volatility of other cryptocurrencies. They also want to stay in the crypto ecosystem for flawless use because of its steadiness.

Originally introduced in 2014, Tether’s design was to peg itself to the US dollar at a 1:1 ratio, maintaining a constant value. Therefore, it is a good choice for traders and investors seeking to balance market volatility without resorting to fiat money.

Tether seeks to give consumers transparency, stability, and low transaction fees while helping fiat currencies integrate with blockchain assets. Every USDT token is aligned with the US dollar at 1:1, ensuring its value accurately represents the underlying fiat money reserves. Tether LTD. does not promise direct USDT exchange or redemption; hence, this should be noted.

How Tether Works?

Every Tether (USDT) is underlined by one US dollar worth of assets. Originally released on the Bitcoin blockchain via the Omni Layer protocol, Tether is now issued on other compatible blockchains supported by Tether.

Once issued, every tether (USDT) performs on the blockchain like any other currency or token. Tether supports several blockchains: Bitcoin, Ethereum, EOS, Tron, Algorand, and OMG Network.

Using a Proof of Reserves system, Tether ensures that its reserves either meet or surpass the Tether token count at any moment. Its official website allows users to confirm this openness.

How Tether (USDT) is Unique?

Despite some criticism, Tether (USDT) stands out among others by virtue of long-standing acceptance and validity inside the blockchain ecosystem. USDT is a dependable payment tool and trade channel widely used across several vendors and systems.

Significant reserves support it and is robust against market volatility and unanticipated events. Standard cryptocurrency features like peer-to-peer trading and robust security measures like PoW or PoS also help USDT, which is why traders and users looking for stability and adaptability choose it.

‘Tether’ A Largest Stablecoin At Present

Tether and other stablecoins are low-volatility digital assets that aim to keep their value steady. These coins are usually tied to reliable assets like gold, the US dollar, or other fiat currencies to guarantee this.

Steve Bumbera, co-founder and lead developer of Many Worlds Token, explains, “The concept is that 1 Tether will always equal $1, regardless of market fluctuations.”

Tether has grown rapidly recently, hitting $113 billion in circulation in July, according to CoinMarketCap.

Crypto traders utilize stablecoins like Tether to provide stable and reliable liquidity, enabling seamless entry and exit from cryptocurrency trades without exposure to unpredictable losses caused by volatile price swings.

Other stablecoins that various assets back Tether issues are as follows:

- Tether Gold (AUXT) is pegged to the price of gold.

- Tether Euro (EURT) is pegged to the euro.

- Tether GBP (GBPT) is pegged to the U.K. pound.

- Tether Yuan (CNHT) is pegged to the Chinese yuan.

Founders of Tether

Renowned businessman Brock Pierce is well-known for participating in cryptocurrency and entertainment projects. He co-founded Blockchain Capital in 2013; by 2017, the venture capital company had raised more than $80 million.

Pierce also directed the Bitcoin Foundation, a non-profit committed to increasing Bitcoin’s acceptance and growth. He co-founded Block.one, the startup driving EOS, a significant cryptocurrency market.

Reeve Collins was the CEO of Tether for its first two years. Before this position, Collins co-founded Traffic Marketplace, an online advertising network, RedLever, an entertainment studio, and Pala Interactive, a gaming website. Collins has worked with marketing and advertising technology-focused SmarMedia Technologies since 2020.

Craig Sellars has actively participated with the Omni Foundation for more than six years, helping to create the Omni Protocol. Users of this protocol can build and trade Bitcoin blockchain smart-contract-based assets and currencies.

Sellars has also had positions with Bitfinex, Factom, Synereo, and the MaidSafe Foundation, among other crypto businesses and startups.

Recent History of Tether

2017

Tether suffered a security hack in November 2017 that resulted in the theft of around $31 million worth of USDT tokens. The company used a hard fork separating a blockchain into two distinct paths to improve security.

Later studies showed that Tether was criticized for the suitability of its reserves and experienced problems getting banking services during this period.

2019

Letitia James, the New York Attorney General, obtained a court ruling against iFinex, the parent company of Tether and BitFinex, in April 2019, which bars further violations of New York law.

Under a money-laundering probe involving its banking partner, Crypto Capital Corp., BitFinex reportedly borrowed about $700 million from Tether’s reserves to offset funds frozen.

2021

Tether and BitFinex resolved with the New York Attorney General’s office by February 2021, agreeing to pay a $18.5 million fine, stop dealing with New York residents or companies, and supply reserve data for two years.

Over claims regarding the backing of Tether, the U.S. Commodity Futures Trading Commission (CFTC) fined Tether $41 million in October 2021. From 2016 to 2018, Tether had enough currency reserves to back USDT tokens completely for just 27.6% of the days, according to the CFTC. Separately resolving CFTC claims, Bitfinex paid a $1.5 million punishment.

2022

Following an unrelated peg issue with TerraUSD (UST) in May 2022, Tether plummeted momentarily to $0.96 per token. It promptly recovered to above $0.99, preserving its 1-to-1 redemption ratio with the U.S. dollar.

2023

Tether acquired Northern Data Group to enter artificial intelligence by 2023, broadening its activities. Former chief technology officer Paolo Ardoino was appointed CEO and brings extensive knowledge of blockchain and Bitcoin financial solutions.

Following a protracted lawsuit against Tether and Bitfinex in November 2023, Judge Laura Swain dismissed the allegations.

July 2024

Tether has hired Philip Gradwell, the former chief economist of Chainalysis, a blockchain analytics company, to take a comparable post at the stablecoin company. Based on a corporate statement July 18, Gradwell will be responsible for measuring the Tether economy for legislators.

Gradwell brings to his new post as head of economics at Tether over six years of expertise as chief economist at Chainalysis.

My goal at Tether is to shift this conversation towards understanding how digital assets are used in the real economy, and how USDT is supporting dollar hegemony.

Gradwell Bitcoin Vs. Tether

According to Daniel Rodriguez, COO of Hill Wealth Strategies, the fundamental distinction between TetherUSD and Bitcoin lies in their underlying assets. Tether is anchored to the U.S. dollar, a non-crypto asset, whereas Bitcoin’s value is solely determined by its market supply and demand.

Furthermore, Tether operates under a centralized model, whereas Bitcoin operates in a decentralized manner. This structural difference theoretically contributes to Tether maintaining more excellent stability than Bitcoin.

Cryptocurrencies not backed by tangible assets or fiat currencies are susceptible to market volatility. Traditional cryptocurrencies like Ethereum and Litecoin (LTC) often experience significant price fluctuations influenced by market conditions, inflation, and interest rates.

Tether seems to be a little more stable because it stays close to the value of one USD, give or take a few cents. Tether isn’t designed to necessarily make money but rather be a stable store of value.

Rodriguez, COO of Hill Wealth Strategies.Tether Price Right Now

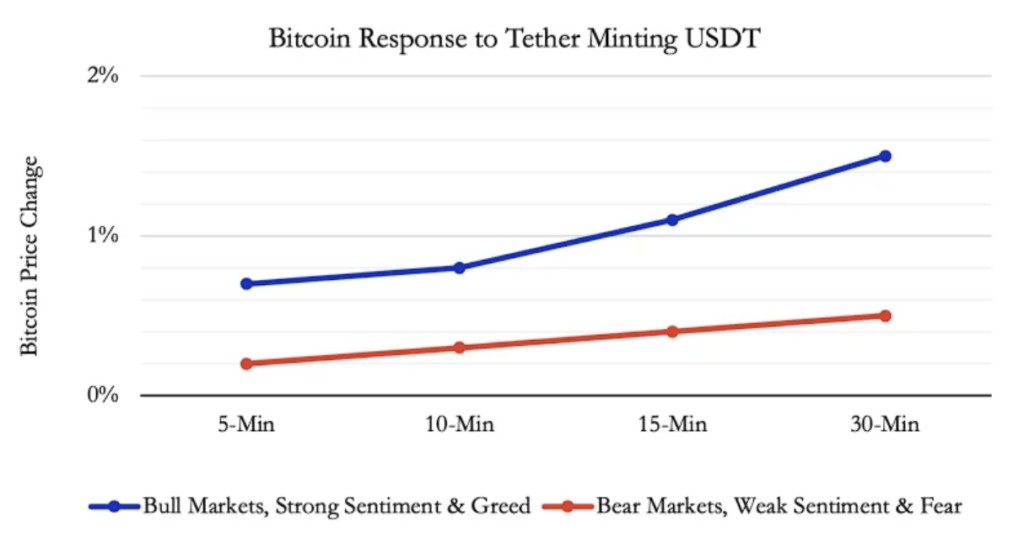

Recent research by Dr Aman Saggu in association with the Blockchain Research Lab shows that Tether’s USDT issuing significantly affects the crypto market.

According to the research, Bitcoin values climb soon after the fresh USDT is created. Following a $1 billion USDT minting event, Bitcoin prices rise specifically by roughly 0.4% in five minutes, 0.5% in ten minutes, 0.6% in fifteen minutes, and 0.8% in thirty minutes.

Given the higher liquidity and demand USDT minting indicates in the market, this trend implies investors view USDT minting as favourable news.

As of July 18, USDT is trading at $0.999, showing a decline of 0.01%.

Tether Integration With AI

Tether (USDT), the leading company in the cryptocurrency industry, has announced a strategic expansion of its AI initiatives, positioning itself at the forefront of technological innovation.

It shows Tether’s commitment to enhancing AI accessibility and efficiency and its role in shaping technology. Tether keeps proving its commitment to creativity. Its core product, USDt, has a market value of over $100 billion. It is also renowned for innovative investments in peer-to-peer telecommunications, renewable energy, and Bitcoin mining.

Tether Data’s AI concentration will be expanded with an eye on numerous important domains. Initially, Tether Data intends to provide open-source, multimodal AI models to establish new industry standards, fostering innovation and accessibility within artificial intelligence technologies.

Tether Data is also starting a worldwide recruitment effort to draw top-notch talent for its expanding AI business. This step into advanced technological fields marks a turning point for the business.

Artificial intelligence stands poised to revolutionize nearly every facet of our lives, both in the real and digital worlds.

Tether CEO Paolo Ardoino.How Tether (USDT) is Secured?

Tether (USDT) tokens can be issued on cryptocurrencies, including Ethereum, EOS, Tron, Algorand, and OMG Network. The underlying blockchain systems of USDT tokens use nodes and miners running under Proof-of-Work or Proof-of-Stake systems, preserving their security. These networks run routine audits to guarantee their code is current, safe, and compliant with legal requirements. Tether also guarantees that USDT stays compliant with the particular criteria of every network.

How to Choose a Tether (USDT) Wallet

Selecting a Tether (USDT) wallet depends on your intended use and the amount you need to store.

- Hardware Wallets

These wallets provide the best security because they have offline storage and backup features. The leading choices are Trezor and Ledger hardware wallets. They are perfect for storing more USDT, especially for experienced users, even if they are more costly and may require more technical knowledge.

- Software Wallets

Free wallets come as smartphone or desktop apps. They can be non-custodial or custodial. Non-custodial wallets keep private keys on your device. Meanwhile, custodial ones manage and back up keys for you. These wallets are less secure than hardware ones. They are better for small USDT balances or beginners.

- Online Wallets

These free, simple-to-use wallets can be accessed from many devices using a web browser. Though handy, they are less secure than hardware or software wallets and are thought to be classified as hot wallets. Online wallets are more suited for holding lesser quantities of USDT or for experienced regular traders since a reliable firm with a good security record should be chosen.

Final Thoughts

Tether, a popular stablecoin, fuels daily transactions worth millions. Despite controversies, it offers stability in volatile markets. Millions worldwide use Tether for decentralized finance across diverse regions.