As a result of the U.S. Securities and Exchange Commission’s (SEC) statement that they will be taking legal action against Uniswap, holders of the UNI governance token are feeling anxious, which is similar to how Ripple’s XRP was monitored by regulators in the past.

After the SEC’s announcement, Analyst looked at how people felt about Uniswap on social media and found a lot of Fear, Uncertainty, and Doubt (FUD). This rise in FUD happened at the same time as a rise in social dominance on April 9th, which was the highest amount seen in 15 months and shows that a lot of people are talking about Uniswap’s regulatory problems.

XRP Influence Spurs UNI Rebound Amid Decline

People have made comparisons to Ripple’s XRP, which saw price increases right after times of increased governmental pressure. Even though the value of UNI has dropped a lot, similar to what happened with XRP, there are signs that it may be about to rise again.

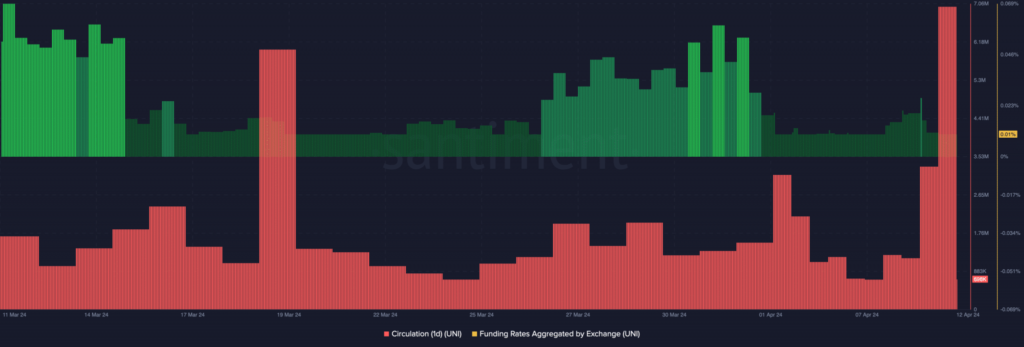

Even though the price of UNI has dropped, on-chain evidence points to a possible recovery. One-day circulation of UNI spiked, which at first meant there was more selling pressure, but then it dropped, which could mean the token’s fall is slowing down.

Uniswap’s Funding Rate, a measure of how people feel in the derivatives market, has shown signs of growth, which makes the case for a comeback even stronger. A drop in funding confidence points to fewer perp sellers and possible interest from spot buyers, which suggests that the price trend may be changing.

But it’s still not clear how long Uniswap’s legal fight with the SEC will last or what will happen in it. Depending on how long the processes last, periods of FUD may continue to appear, which could cause UNI’s price to change. If things are quickly resolved, on the other hand, UNI’s value could rise significantly, similar to how other altcoins have done in similar situations.