Solana (SOL) fell more than 12% in value this week, and it was worth $128 at 11:06 a.m. UTC on September 4. According to Lookonchain, the memecoin site Pump.fun has sold a lot of SOL tokens, $41.64 million worth, at an average price of $157.50 each. This drop comes after those sales.

Solana’s price has been going down because of what Pump.fun did, which included a $1.38 million sale on September 3. Large transactions like these, which are often done by “whales” or large holders, can have a major effect on the market. Traders keep a close eye on these kinds of transactions for short-term price signals.

“The Pump.fun Fee Account sold 10,300 $SOL ($1.38M) at $134.46 again 40 mins ago!”

Solana Faces Memecoin Pressure

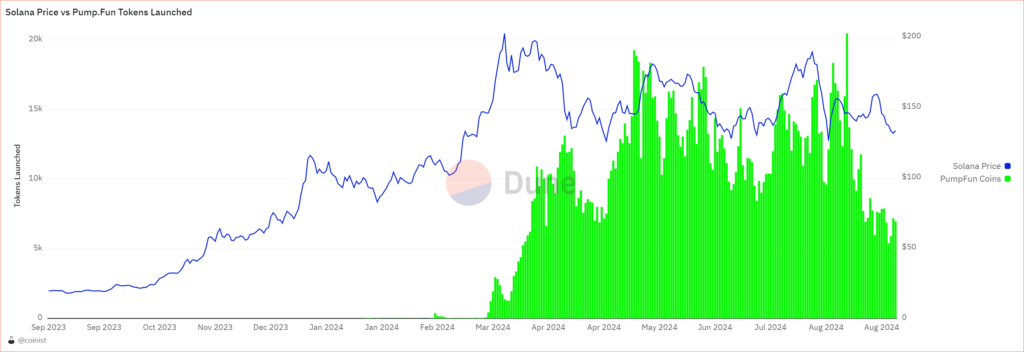

People think that the new memecoin craze on the Solana network is another reason for the token’s price drop. Luke Martin is a crypto trader and podcast host who said that Solana’s rally stopped when people started starting mass memecoins on Pump.fun, which put even more pressure on the token’s value.

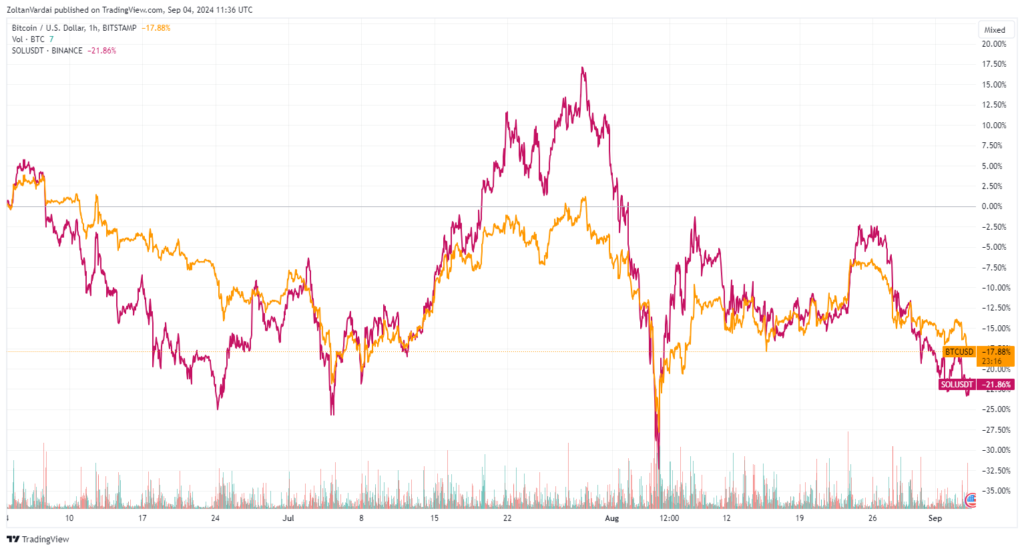

Also, the price of Solana is still directly linked to the performance of Bitcoin. Bitstamp data shows that in the last three months, the price of SOL has dropped almost 22% and the price of Bitcoin has dropped about 18%.

“Considering the current election season and the prevailing sentiment, it is likely that we will see the approval of Solana ETFs before the end of this year. The key question is whether this will happen before or after the elections.”

Despite this instability, there is talk that Solana could become the next major coin to get an exchange-traded fund (ETF) in the US. This comes after Brazil approved the first SOL ETF on August 7. A US Solana ETF could have a major effect on prices, but its approval is still up in the air.

Alejo Pinto, co-founder of the SOL layer-2 network Lumio and former IBM blockchain growth lead, and Manthan Dave, co-founder of the Ripple-backed platform Palisade, both say that an ETF could potentially make SOL price go up a lot. Some people think it could launch by the end of 2024. As of February 15, about 75% of all new money invested in Bitcoin came from spot ETFs. This helped push the price over $50,000.