Bitwise has submitted the first approved ETF for XRP assets to the SEC. Once SEC approval is secured investors will gain straightforward access to the worth of XRP within the trust minus costs and obligations.

Bitwise CEO Hunter Horsley highlighted the company’s faith in blockchain and its ability to generate fresh financial assets and decentralized applications. Horsley revealed his joy with the filing and noted Bitwise’s dedication to creating investment opportunities in the digital currency field.

XRP ETF Trust Filed October 2

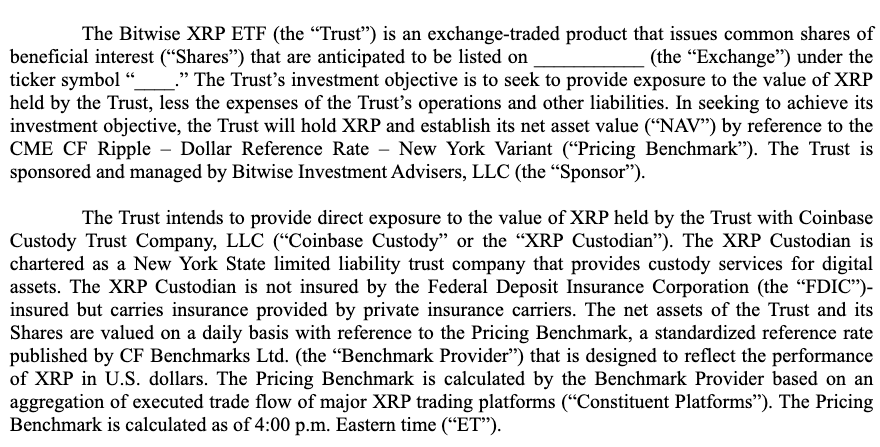

As per the submission document XRP will be preserved alongside Coinbase Custody Trust Company for other Bitwise crypto ETF investments. The Federal Deposit Insurance Corporation (FDIC) does not protect the custodian’s assets; however private insurers will safeguard the holdings.

In the creation and redemption of shares for the ETF Bitwise will stick to a cash-create approach; if the firm secures regulatory clearance for in-kind redemptions it will communicate with shareholders.

On October 2 in Delaware Bitwise filed to create the XRP ETF Trust. In January of last year Bitwise introduced a Bitcoin ETF while starting trading of Ether ETFs in July. Bitwise has not made an application for Solana ETFs while other companies like VanEck have already filed.

“That’s simply not in their DNA. This is strategic.”

Nate Geraci said the XRP ETF filing stands out and pointed to potential links with the upcoming November elections. In addition to the XRP ETF filing from Bitwise Capital Management Inc., journalist Eleanor Terrett revealed that a crypto investment firm called Canary Capital had done the same on September 24.

The approval for Ripple’s license from Dubai’s Financial Service Authority has enabled the blockchain firm to launch cross-border payment services in the region after its complete licensing.