Analysts say that Bitcoin’s open interest has risen above $35 billion, which makes them worry that the market might get too hot.

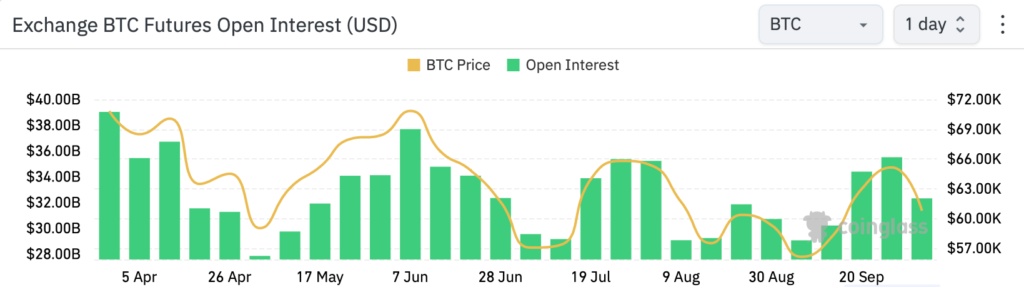

In a report released on October 1, Bitfinex said that Bitcoin’s open interest (OI), which is the total number of unsettled futures contracts, has hit levels that have historically been linked to price peaks in the area. OI hit $35.52 billion on September 27, the most since June, when Bitcoin was trading close to its all-time high of $70,759 million. The price dropped 18% soon after.

Bitcoin Open Interest Surge

Analysts say that this rise in open interest could be a sign of market froth, and some even predict a time of cooling. OI has gone down by 9% since its high point to $32.32 billion, and BTC price has dropped to $61,629, a drop of 4.36 % in the last week.

Tensions in the Middle East have made the market even less certain. Bitfinex analysts are still optimistic, even though the price has gone down. They say that a 5–10% drop could reset the market without hurting the general bullish momentum.

But some traders are still being cautious, and QCP Capital has warned of more drops that could happen if global tensions get worse. They think that Bitcoin could drop to $55,000 if things get worse.