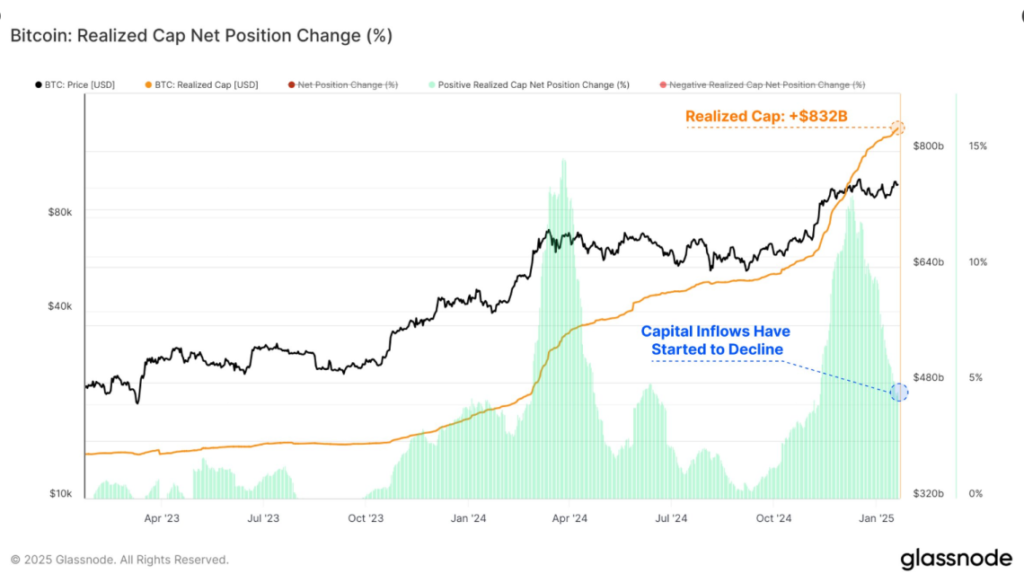

A new high of $832 billion realized capitalization confirms growing investor trust even though money flows into Bitcoin are slowing down. The data from Glassnode shows Bitcoin remains strong although investors keep sending it alternating amounts of money.

Realized capitalization measures Bitcoin transactions differently than market cap. It looks at the last price each Bitcoin was sold for instead of using its present market price. This tool helps investors understand market dynamics by showing where established owners cash out their investments and where new participants join the market.

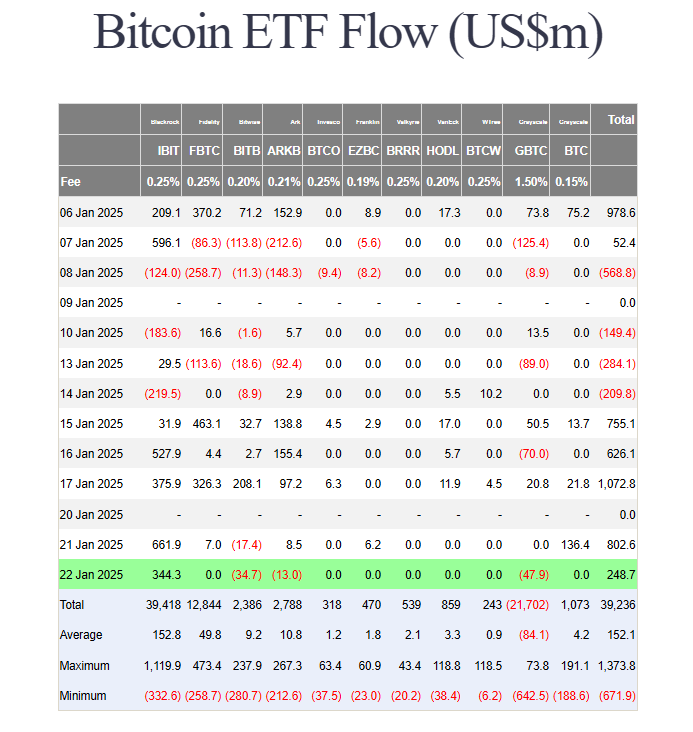

Bitcoin ETF Flows Shift

The latest benchmark appears during a time when investment money flows into the market show mixed results. BTC Exchange-Traded Funds (ETFs) recorded $1.21 billion in withdrawal which indicates institutions no longer believe in BTC . After a decline of $1.21 billion the trend in Bitcoin Exchange-Traded Funds reversed to show $3.26 billion inflow from January 15 particularly $1 billion on January 17.

BTC proves its lasting value thanks to sudden and strong market demand. Investors now consider BTC as a permanent way to protect wealth instead of viewing it only as a trading tool. Investors who held BTC for a long period made profits during this market phase as new buyers purchased more BTC at increasing prices boosting its total amount of realized profits.

More investors now use BTC as a safe investment like they do with gold. Market confidence rises when more investors put money into BTC but slower deposits become harder to handle when they continue for long. Bitcoin shows signs of financial maturation through its successful price achievements during these times.

BTC realized cap hits $832B despite slowing inflows, signaling strong investor confidence as ETFs reverse trends and market maturity strengthens.