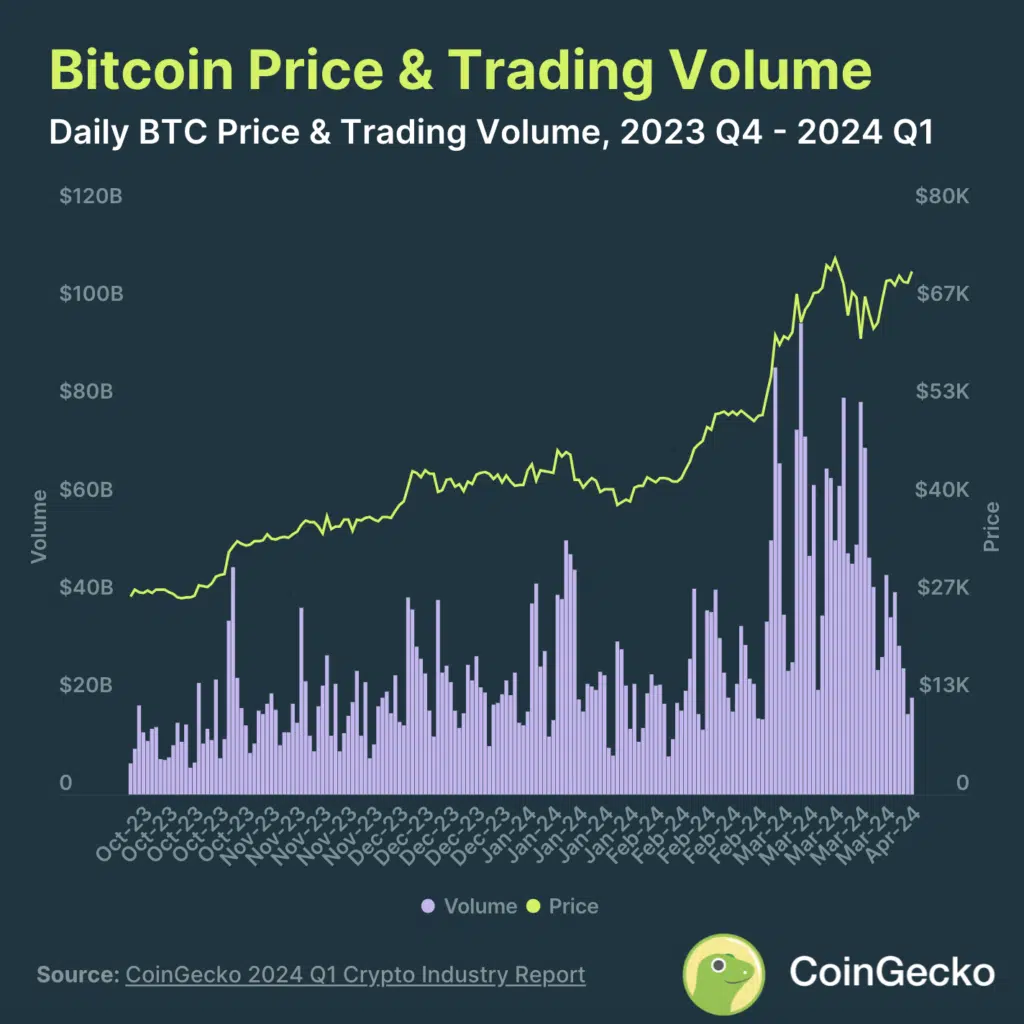

CoinGecko’s experts shared much information about the crypto market’s performance in the first quarter, pointing out a significant increase in the sector’s value. The study says the crypto market grew significantly in the first quarter. The sector’s capitalization rose by 64.5%, reaching $2.9 trillion in March.

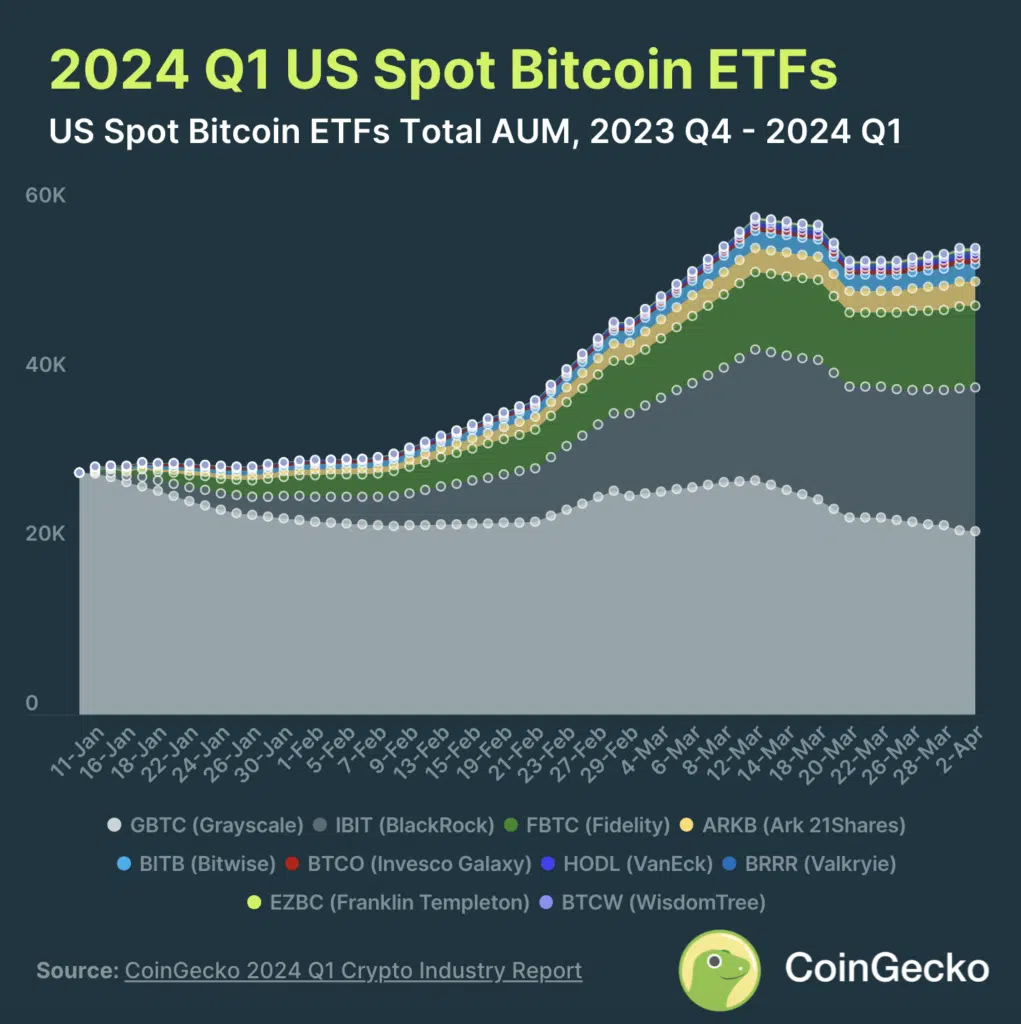

Capitalization grew by $1.1 trillion, almost twice as much as the growth seen in the fourth quarter of 2024, which was $0.61 trillion. Notably, this rise was driven by a large influx of capital into spot Bitcoin ETFs after they were approved on January 10.

The trend increased from late January until mid-March when the capitalization rate reached a temporary high point.

CoinGecko’s Insights Key Findings on Bitcoin and ETFs

According to CoinGecko, the amount of funds managed for U.S. Spot Bitcoin ETFs increased to $55.1 billion during the quarter. The largest position is still held by Grayscale Bitcoin Trust ETF (GBTC), but iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have made big steps toward closing the gap.

The analysis shows that Bitcoin witnessed an amazing 68.8% growth during the quarter, hitting its all-time high. Binance Research said that the market capitalization had grown by 16.3% in just one month. Even though funds continued to show positive trends, funds flow into spot Bitcoin ETFs slowed toward the end of March.

Since January, over $12 billion has been invested in Bitcoin exchange-traded funds, which shows that investors are still interested in the cryptocurrency.

The CoinGecko study gives useful information about how the crypto market changes, showing how strong the sector is and how investors are becoming more confident in digital assets.

Binance Research said that the market capitalization had grown by 16.3% in just one month. Even though funds continued to show positive trends, money flows into spot Bitcoin ETFs slowed toward the end of March.