The long-awaited halving of Bitcoin happened on April 20. As a result, network fees in the bitcoin market went up quickly. It was thought that Bitcoin’s transaction fees would go down after they were halved, but they went up to a new high. People aren’t sure if this trend will keep going.

From what Glassnode could tell, Bitcoin’s network fees rose to over 1,257 BTC on the day of the split. That’s more than $81 million at the time. It had been years since the daily fee had been that high. This meant that trades cost both users and miners a lot more.

Bitcoin’s Fees Decrease After Initial Surge

However, even though fees went up at first, they have since gone down a lot. The price of Glassnode dropped to 344 BTC, which is around $22.3 million. It’s clear that purchase prices changed a great deal very quickly.

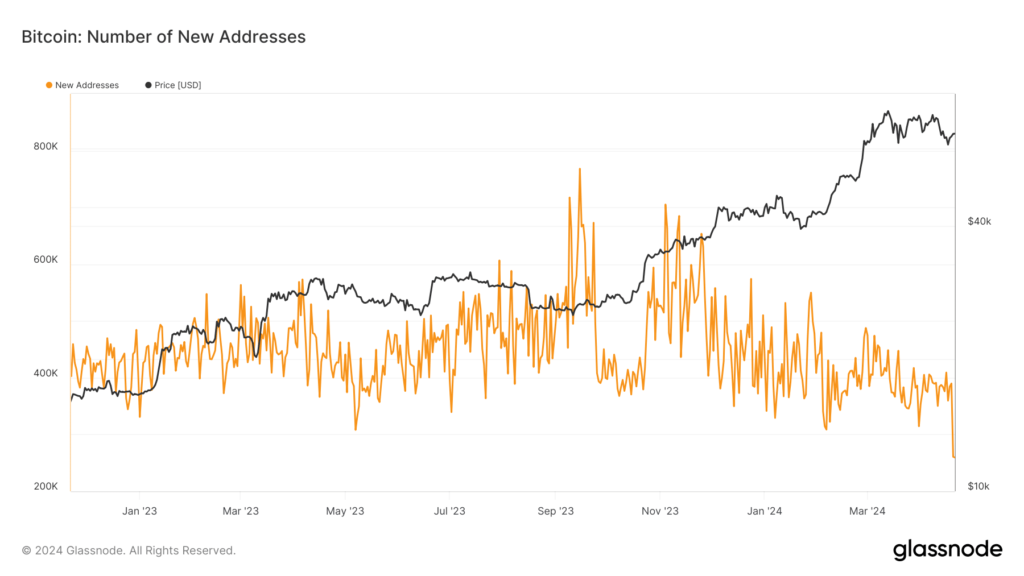

It’s interesting that this rise in fees happened at the same time that fewer new Bitcoin addresses were being made every day. A study by analyst showed that the number of new addresses was going down, which suggests that the rise in fees wasn’t caused by an immense spike of new users.

Instead, discussion spread about the Runestone project and how it might change the fees for transactions. This idea was supported by the next drop in fees, which showed that the fee increase might not have been due to more users but to outside causes.

It didn’t change much in price, even though fees did go up. On April 21, it went down a bit but then went back up. As this was written, the price of BTC was around $66,200, which is a small 1.7% increase.

People who study cryptocurrencies said that Bitcoin’s rise was not yet over, but the market kept cautiously optimistic. To show that it is back on a rising trend, it would need to break above key support levels. This could cause prices to rise even more.