A current Bitfinex Alpha study claims that, even as seasoned owners retain their positions, the Bitcoin market is changing dynamically with an infusion of short-term traders.

The report draws attention to a distinct disparity in investment behavior: although new entrants are seeking quick profits, long-term holders—sometimes called as “hodlers—are accumulating Bitcoin.

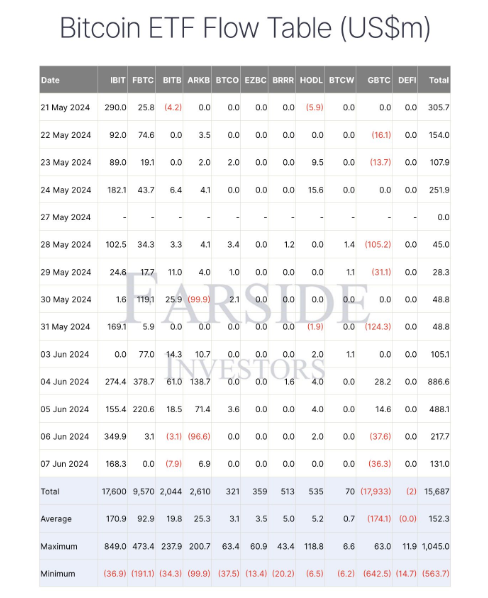

Monitoring Bitcoin’s price, spot Bitcoin ETFs have become a main player in this movement. These instruments draw a new breed of investors focused on quick gains.

Bitcoin Sees Surge In Speculation

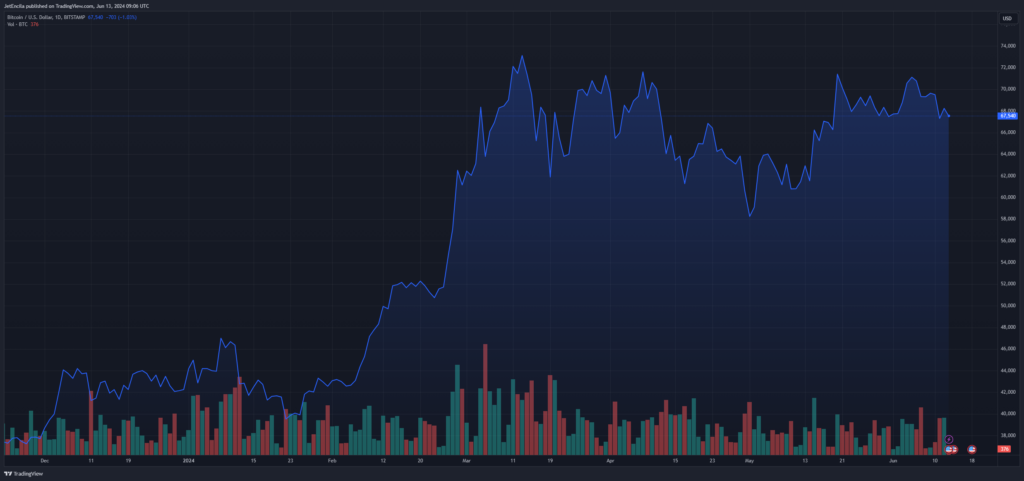

Holding values by short-term investors—those with Bitcoin for fewer than 155 days—have jumped by over 55%, indicating more speculative activity since January.

The study does caution, though, that these short-term players are more vulnerable to changes in the market. A sudden market correction could cause a sell-off, hence raising the price volatility. The present “greed” attitude in the market, as shown by the Fear & Greed Index, emphasizes this warning.

Long-term holders, meantime, are still convinced about the future of BTC. They have started buying again, showing a strong belief in future profits even though they sold some assets at the all-time high in March. Reflecting a “hodling,” the research states that these investors had modest BTC holdings acquired above the current price.

Reflecting prior behavior before the 2020 bull run, large investors—also known as BTC whales—are also acquiring BTC, suggesting a possible price surge.

The current market environment is thus defined by a mix of fresh energy and possibly volatility from short-term investors, balanced by the stability supplied by long-term holdings.

Bitfinex Alpha’s analysis also shows a technical study showing a 29.51% rise in Bitcoin’s price, maybe reaching $87,897 by July 13, 2024. It does, however, underline the mixed attitude of the market and the prospect for price changes among considerable investor enthusiasm.