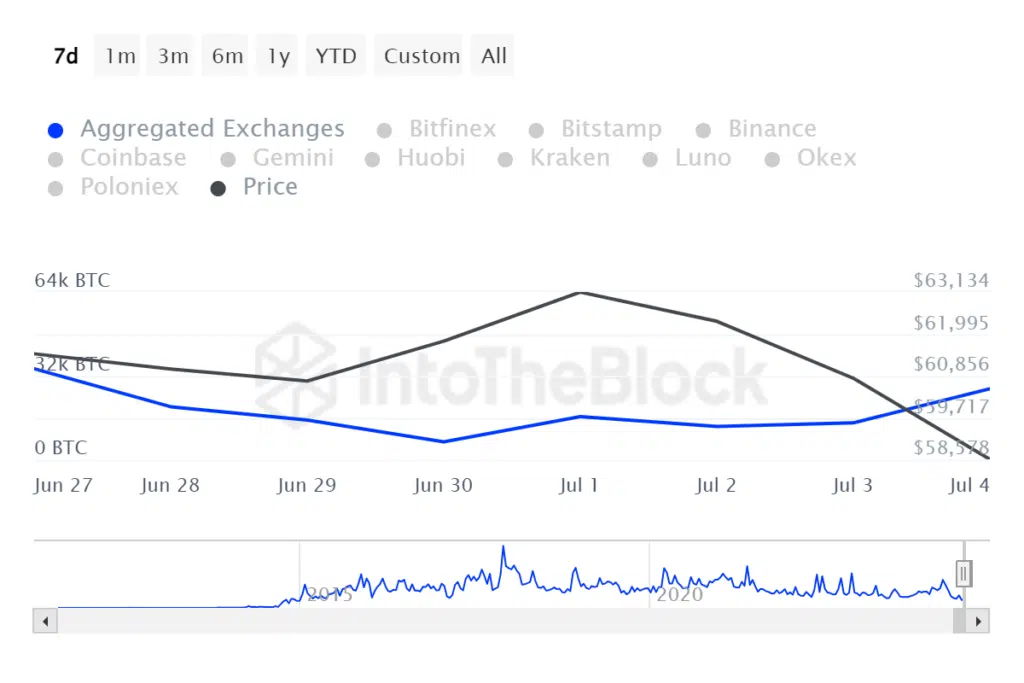

This week, people bought more than $1.2 billion worth of Bitcoin (BTC) on centralized markets, which made it easier for people to sell. There were a lot more trades during this time when the market was down.

IntoTheBlock found that in the past week, more than 21,000 BTC have been sent to big exchanges like Binance and Coinbase. At the same time that these exchange payments went up, the price of Bitcoin was selling for about $55,000 on Friday. This shows that buyers are still being careful in the world of digital assets because of how unstable things are.

Bitcoin’s Decline Amid Economic Uncertainty and Regulatory Moves

Bitcoin’s value has dropped 21% in the last month due to a lot of different economic causes. This shows that the market as a whole is worried. Analysts said that the long-lasting bearish trend was due to uncertainty about the economy, withdrawals by institutions, moves by the government, debt repayments, and an unstable market.

There were signs that inflation was slowing down in the US economy, but not enough to make the Federal Reserve cut interest rates as planned. The central bank’s unwavering commitment to its 2% inflation goal has made investors less willing to take risks, which has further changed the way the market works.

In the meantime, miners sold a lot of cryptocurrency to cover the costs of running their businesses after Bitcoin’s halving event earlier this year, which cut mining payouts in half. Even though steps have been made to stabilize it, Bitcoin hasn’t been able to get back on track since its high point of $73,000 in March. It has mostly been moving sideways or down.

James Seyffart, an expert on ETFs, pointed out that the lack of spot BTC ETF flows and trade volumes on Wall Street have been similar to Bitcoin’s price changes. This shows how digital asset markets are linked to traditional financial sectors.

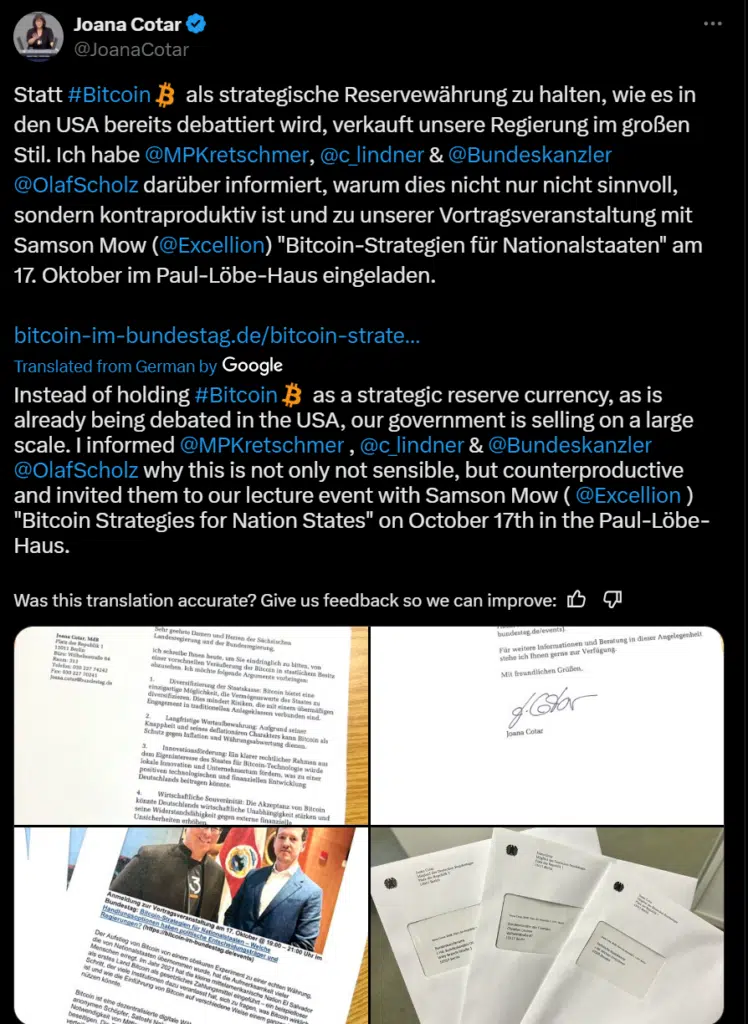

In the past few weeks, moves by the government have also been very important in how the market works. Authorities in both Germany and the US have sent large amounts of Bitcoin to exchanges. This shows that the governments are trying to keep track of stolen assets and could affect the market’s liquidity.

Germany’s government’s move to sell off seized Bitcoin has been criticized. Some lawmakers want the digital currency to be kept as a reserve asset instead of being sold on open markets. In the same way, the U.S. government’s transfer of $240 million in seized Silk Road Bitcoin to Coinbase has been closely watched, especially since cryptocurrency companies are currently being sued.

The value of Bitcoin fell by 2% on Friday. This was partly because people were getting their money back from the now-defunct Mt. Gox exchange. Ten years ago, one of the biggest Bitcoin hacks in history happened, and the exchange started doing this.

The market for all cryptocurrencies fell 8% in one day because of Bitcoin’s drop. Its total value hit a five-month low of $2 trillion. Even though there have been failures lately, the business of digital assets has been strong over longer periods of time. It has grown by 24% in the last six months and by a strong 73% in the last year.

Bitcoin is still having a rough time because of tightening regulations and a volatile market. Experts and investors are still looking for signs that the world of cryptocurrencies will either level off or begin to grow again.