Binance, a prominent player in the dynamic realm of cryptocurrency trading, has experienced a discernible waning of its dominance, having relinquished roughly 25% of its Bitcoin market share. The decrease aligns with the offshore markets’ diversification as competitors like as Bybit make significant headway.

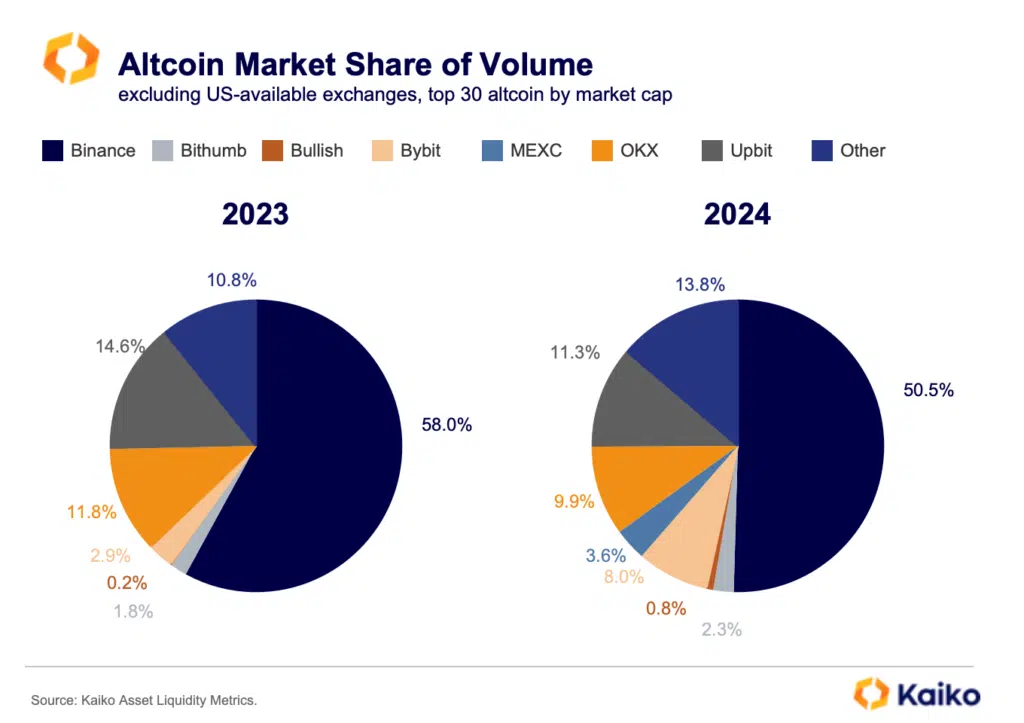

Over the past year, Binance’s dominance over Bitcoin trading outside of the US has dropped from 81.3% to 55.3%. Simultaneously with this modification, it ended its big Bitcoin zero-fee push, opening up new avenues for competition. Similar patterns may be observed in smaller altcoins, where data from Kaiko indicates that Cryptocurrency Exchange share has dropped from 58% to 50.5%.

Binance Faces Market Competition.

Analysts from a Paris-based group claim that the increasing amount of market competition is the reason behind these discrepancies. With trading volumes starting to increase once more, smaller exchanges are seizing the chance to gain traction. Two examples of platforms that are expanding, particularly in Asia, are Bybit and OKX. OKX’s stake in non-US Bitcoin trading has expanded from 3% to 7.3%, while Bybit’s share has increased substantially from 2% to 9.3%. Experts have also observed notable rises in MEXC, Bithumb, and Bullish.

Meanwhile, Binance is facing a number of challenges, the most significant of which stem from a $4.3 billion deal with US authorities. The restrictions imposed by this agreement have affected the exchange’s operations. Noah Perlman, Binance’s COO,