Bitcoin (BTC) has changed in market behavior, separating from the currently hopeful U.S. stocks since challenges surpassed the $63,000 price barrier. This thrill subsided mid-year, though, as Bitcoin suffered in June under several headwinds. From its March top, BTC is now down roughly 15%.

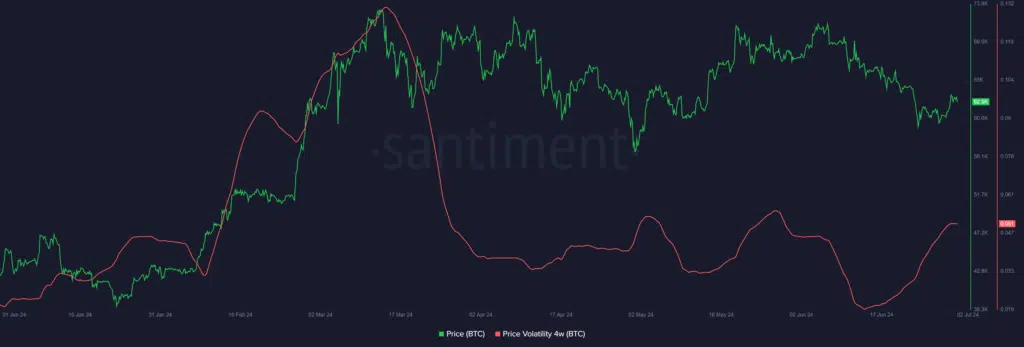

According to Bitfinex analysts, current rules have greatly reduced Bitcoin’s volatility and hampered its upward speed. From 0.1306 in mid-March to a yearly low of 0.0198 in June, data from Santiment shows a sharp decline in Bitcoin’s weekly volatility.

The behavior of long-term holders is a major determinant of this trend. Bitfinex analysts noted that these holders who stopped selling in early May have started dumping their assets. Nevertheless, The market is much influenced by this resumption of sales and a supply overhang.

Bitcoin Faces Profit-Taking By Long-Term Holders

According to on-chain statistics, long-term holders are reportedly returning profits once more, even at prices below the ATH of roughly $69,000. Although miner sell-offs have dropped, indicating some market stabilization, the near-term view for BTC is negative, given the huge levels of profit realization by long-term holders.

One leading cause of the supply overhang is the possible selling by Mt. Gox depositors and the German government, which have significant Bitcoin holdings and could liquidate their assets. This prospect has added to investor FUD, fear, uncertainty, and doubt.

Based on the analysis, various indicators in the larger macroeconomic context might help risk assets like Bitcoin. May’s Personal Consumption Expenditures Index, which the Federal Reserve bases on to gauge inflation, stayed constant. Analysts also noted that this consistency fuels hope for a September rate drop. In line with this viewpoint, the most recent third-quarter estimate for U.S. GDP exposes underlying flaws in a slow declining consumer confidence.

Bitcoin has not benefited as projected despite these beneficial economic times. Rather, BTC has decoupled from American stocks, which have kept their increasing trend. While the SPX gained 3.5%, Bitcoin slumped more than 8% in June.

Bitfinex analysts claim that other causes of this discrepancy are not solely supply-related. They reference news-induced selloffs and speculative buying. Negative news currently influences BTC more because of the declining interest in the spot market and the recent negative net flows from investment products.

Though July’s BTC has a generally optimistic view, the currency is already down 0.18% this month due to a 0.35% decrease this morning. Having wiped all the meager gains it made on the first day of the month, Bitcoin is trading at $62,675 at the time of writing.