Recent data shows that Bitcoin spot exchange-traded funds (ETFs) in the United States have suffered continuous withdrawals, equating to about $140 million as of June 20. Prominent news source Wu Blockchain revealed the continuous trend of significant withdrawals from Bitcoin ETFs, signifying the fifth straight day of outflows.

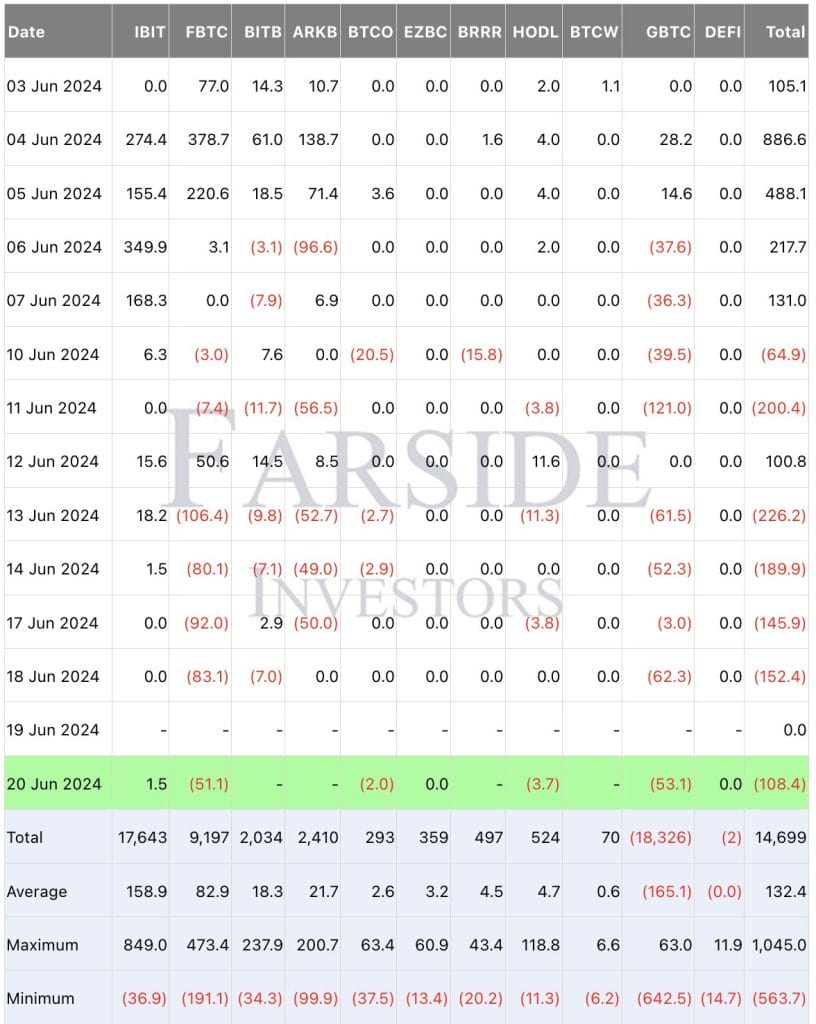

“On June 20, Grayscale’s ETF GBTC experienced a single-day outflow of $53.1022 million, while BlackRock’s ETF IBIT saw a single-day inflow of $1.4791 million,” Wu Blockchain noted in its research.

These outflows have particularly affected big businesses in the sector, such as Fidelity and Grayscale. Data from SoSo Value shows Fidelity’s FBTC to have seen a one-day net outflow of $51 million. Right now, Bitcoin spot ETFs have a net asset value overall of $56.41 billion.

Bitcoin ETF Outflows Highlight Investor Concerns And Market Dynamics

On June 19, just one day earlier, BTC spot ETF net outflow came to $152 million. Grayscale’s GBTC alone showed a net outflow of $62.3397 million on Wednesday, highlighting the extent of investor withdrawals in a brief period. Data from Farside shows the degree of the recent migration from Bitcoin ETFs since the start of the month, reflecting changing investor mood.

Investors in the US have grown worried about the ongoing outflows from Bitcoin spot ETFs, casting doubt on their faith in the currency’s short-term price prediction. Some conjecture that investors might be shifting money into other cryptocurrencies, including Ethereum ETFs.

These fund outflows have matched a recent downturn in the price path of Bitcoin.

At the time of reporting, the cryptocurrency which traded at $66,474 in the past 24 hours is now valued at $64,552.

Analysts, including BTC specialist Willy Woo, have provided views on the market mechanics behind the price standstill in the face of outflows. Woo underlined a rare miner capitulation occurrence brought on by Bitcoin’s halving, which has reduced mining activity and consequent BTC sell-offs.

“The halving event killing lesser miners is causing an unusual miner capitulation right now . Usually, before price rebates, they sell BTC as they leave, Woo said, stressing the need for more liquidations before expected positive market activity.

As players negotiate price changes and strategic reallocations among shifting market conditions, the situation emphasizes the continuous volatility and changing investor mood within the Bitcoin market.