On the bitcoin market, bitcoin is very valuable since it can be bought and sold at any time. Kaiko has released a new study that says the number of Bitcoin deals on the weekends has sunk to an all-time low. Major investors may have more time to work during the week now.

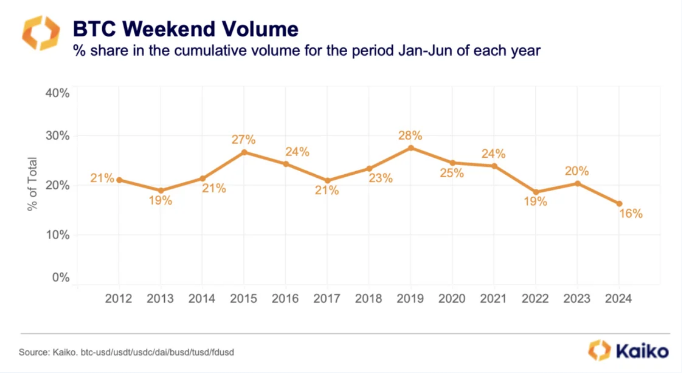

Kaiko’s data shows that the percentage of people buying Bitcoin on the weekend has dropped sharply, from 28% in 2019 to 16% in 2024. Coin spot ETFs are about to start dealing in the US at the same time as this drop. Like stocks, these ETFs will only trade when the market is open.

Bitcoin Trading Patterns Shift

It’s clear that institutional investors who like these regulated goods are setting new trading trends. There was more buying in Bitcoin during the “benchmark fixing window,” which is the last hour of trading on the US stock market. This change shows that banks now value trading during the week more than on the weekends, when it used to be very busy.

More people aren’t dealing on the weekends because of more than just ETFs. It also helped that crypto-friendly banks like Signature and Silicon Valley Bank closed in March 2023. It was possible for buy and sell orders to happen all the time because of these banks. Their removal has made it harder to trade on the weekends.

Traders can still find a good deal on the weekends, even though not as many people are buying. If Bitcoin doesn’t change as much over the weekend, it might become a more stable currency. This might make institutions more interested. July has been a good month for BTC in the past. The price has gone up seven times in the last eleven Julys.

For the next few weeks, the crypto market should be very busy. On the weekends, trade may slow down. Some people think that letting Ethereum ETFs work could bring in even more businesses and make Bitcoin less important in the market.

Why did business drop so much over the weekend? It’s possible that the Bitcoin market is going through a significant shift. The way major businesses buy things is changing, which might make the market more stable. Buyers should be careful this month because there may still be a lot of change.