In the most recent report, a quantitative analyst talked about the chance of a Bitcoin rally in the third quarter, pointing out that the end of miner selloffs as a major reason. A CryptoQuant Quicktake study says that worries about miners’ pressure to sell have recently gone away. The study is mostly about two main on-chain indicators.

The first indicator, “Miner to Exchange Transactions,” shows how much funds is moving from wallets used by miners to exchange sites. High prices usually mean that miners are selling more, which could put downward pressure on the market. On the other hand, smaller values mean that traders are neutral or bullish, which means that fewer miners are selling on exchanges.

Bitcoin Recovers, Hits $63,700 In 24 Hours

A new picture shows how Bitcoin Miner to Exchange Transactions have changed over the past year. It shows a substantial rise from the end of 2023 to April 2024, which is the same time when the price of cryptocurrencies went up. As prices got closer to all-time highs, miners seemed likely to take advantage of the rise by selling more. But since April, there has been a clear drop in this measure, which suggests that miners are selling less.

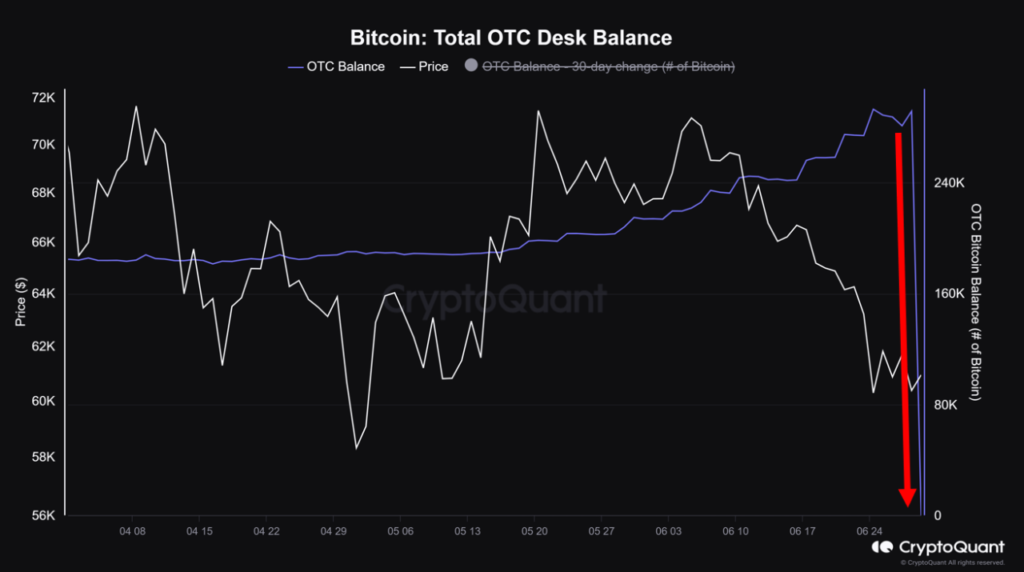

Notably, miners also use over-the-counter (OTC) desks to sell, as shown in a different picture called “Total OTC Desk Balance.” This measure keeps an eye on wallets that aren’t linked to exchanges where miners send coins to be sold. New information shows that the OTC Desk Balance has gone down a lot, which suggests that coins that were stored may have been bought.

The expert summed up the results and said that since there is less selling pressure on both exchanges and over-the-counter (OTC) desks, Bitcoin prices could go up in the third quarter of 2024. This study fits with recent price changes. Bitcoin has been recovering and has gone over $63,700 in the last 24 hours.