Over the weekend, bitcoin traded within a very tight bullish price range of $88,700 to $91,700, and there was very strong price stability. The cryptocurrency also holds these levels despite very limited movement, a sign of growing confidence and strength of the market.

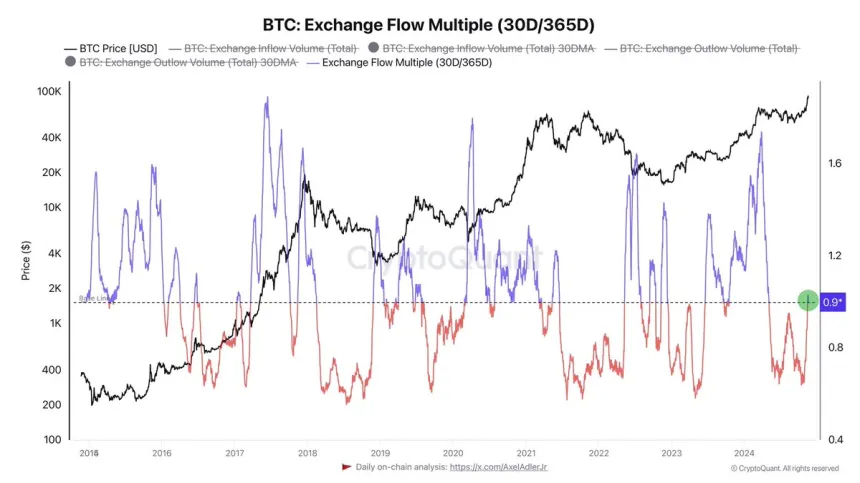

CryptoQuant’s key on-chain data shows that selling pressure has dramatically decreased and fewer Bitcoin sellers are in the market. That fits the prevailing bullish mood and driven by increasing demand beyond supply, could drive the price higher.

Bitcoin Surges 39%, Limited Selling Pressure Supports Growth

This has been helped by the tightening supply and expectations of the trend continuing upwards in the months ahead. As selling activity continues to ebb while demand increases, leading analysts expect another large Bitcoin increase.

BTC has scaled 39% in just nine days, one of the boldest of this cycle. BTC is currently holding above key levels and this price surge has excited as well as cautious investors. What’s more, there are less and fewer opportunities to buy at lower prices.

CryptoQuant analyst Axel Adler, however, noted that BTC inflow to exchanges over the last 30 days has sat near the 365 day average, suggesting there is little selling pressure. This means that current holders are primed to hold their BTC rather than sell into rally, it bodes positively for a further price rise.

However, analysts say a consolidation at current price levels could stabilize support and draw in fresh demand. Bitcoin, which is trading at $91,700 is just 2% away from its all time high, $93,483. Investor hope has been amplified by the proximity to this record price, some of which believe Bitcoin will breach its previous peak this week.

There is however some caution. At $87,000, Bitcoin could dip for a short time before starting its next boost.