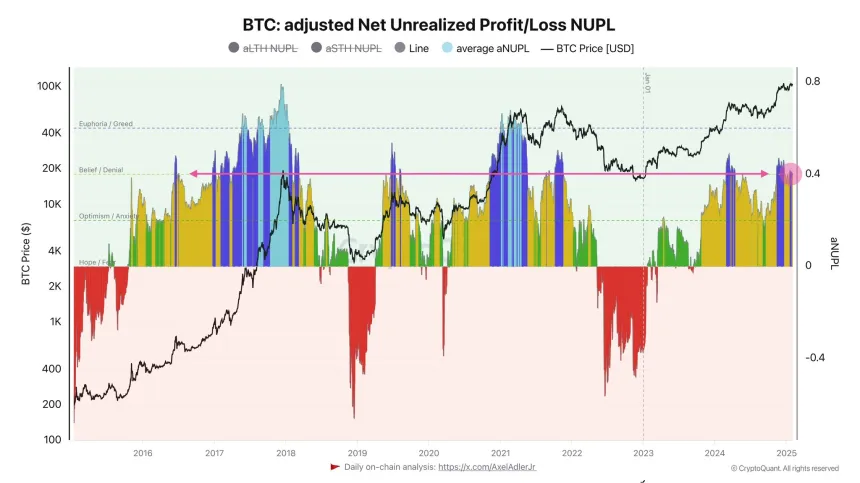

Crypto analyst Axel Adler Jr reports Bitcoin bulls still maintain their grip against a market trend change. The adjusted Net Unrealized Profit/Loss (aNUPL) indicator confirms the market remains cool which indicates room for additional price increases.

The aNUPL indicator, a key metric in crypto trading, measures investors’ unrealized profits and losses to gauge market sentiment. Investor optimism about Bitcoin stands at 0.4 percent which indicates a balanced market approach.

Bitcoin Market Stability Continues

The speculator activity during bull market peaks in 2017 and 2021 reached the 0.7-0.8 level signifying excessive market expansion. After September 2024 the market has continued its positive trend without approaching extreme highs. The Bitcoin market stabilized around $100,824 with a day-to-day drop of 1.72%.

The Relative Strength Index value of 50.43 shows that Bitcoin continues advancing and has room to grow before hitting the overbought zone. Furthermore BTC price continues to advance since September 2024 because its 100-day simple moving average stands underneath the marketplace price.

BTC confronts a strong mental obstacle around its $106000 price point. If prices climb past $106000 they may reach their previous record value of $109114. When new rejections happen after the second week then the price may keep going through the consolidation period.

BTC shows strong market potential in future months based on investor forecasts. The strong bullish market attitude arises from both recent price trends and Donald Trump administration support. Experts predict BTC will reach values between $150,000 and $350,000 during this market cycle unless unexpected economic changes occur.

Bitcoin stays strong as people closely watch developing patterns and resistance points to predict its next major movement forward.