Bitcoin’s hashprice, which is a key indicator of how profitable miners are, is now showing conditions similar to those before the cryptocurrency hit new all-time highs in 2020. This means that the way prices are moving right now might be a good time to buy, even though miners are still having a hard time.

CryptoQuant, an on-chain analytics tool, pointed out on August 30 that Bitcoin’s price is getting close to long-term lows. Even though miners and long-term holders are under a lot of pressure, signs are still pointing up.

Bitcoin Miners Face Profit Struggles

Hashprice, which shows how much it costs miners per terahash, is still very low, which makes it hard for them to make funds after the split. CryptoQuant’s historical data shows that these low hash rates have happened before, at the same time as Bitcoin price lows and often before major price rises.

“The highlighted parts of the chart show times when the hashprice dropped, which happened at the same time that Bitcoin prices were at or near their lowest,” CryptoQuant writer Woo Mink-yu said, referring to a chart that shows the relationship between the hashprice and BTC prices.

“Historically, these lower Hash Price periods have coincided with Bitcoin price bottoms, suggesting that the current low Hash Price might indicate that Bitcoin’s price is near a bottom as well.”

The last time something like this happened was after the COVID-19 market crash in 2020 and went on until the BTC split event that same year.

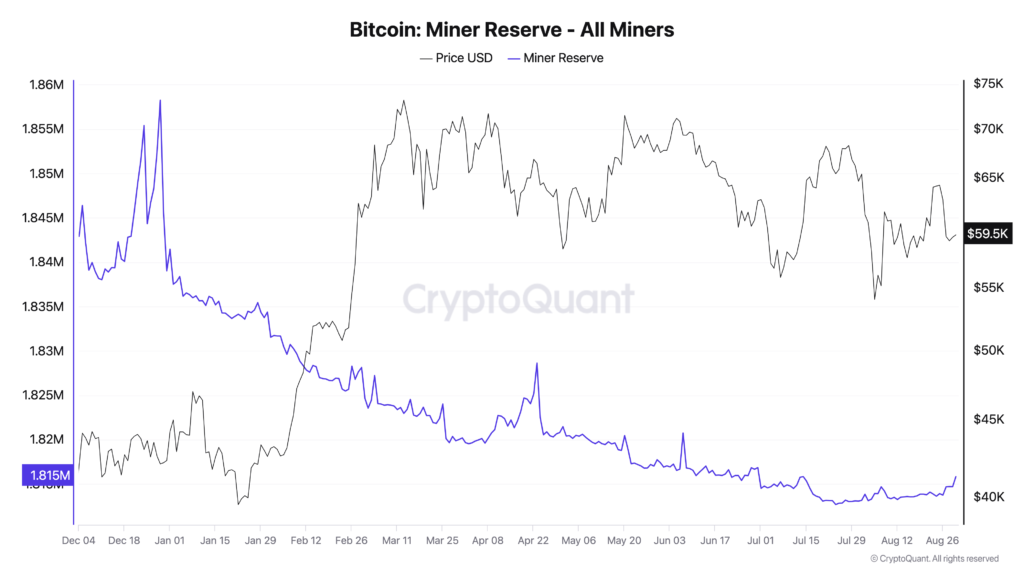

New information shows that miner withdrawals have slowed down since July, and their BTC reserves have grown to 1,815,832 BTC. BTC.com also says that Bitcoin’s mining difficulty went up by 3% this week, getting close to a record high of 90.66 trillion.

CryptoQuant CEO Ki Young Ju said earlier in August that the U.S. mining sector seems to be on the way to sustainability, with miner withdrawals almost over and the hashrate getting close to all-time highs, as shown by the Hash Ribbons indicator.