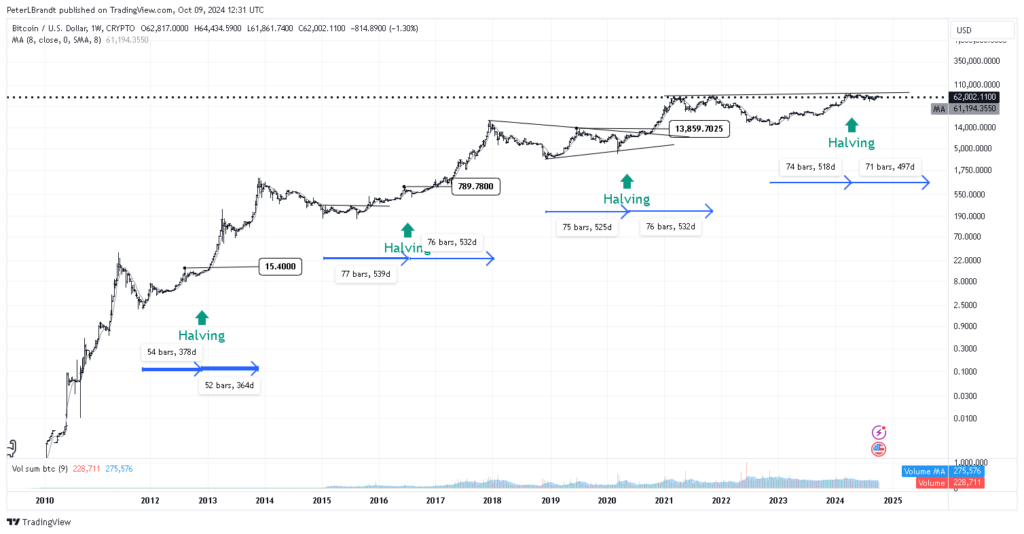

Veteran trader Peter Brandt believes bitcoin (BTC) could rise to $135,000 in 2025 as long as its price remains above $48,000. In an X update posted on October 9th that instead took the opportunity to lay out his hopes for Bitcoin, Brandt wanted to avoid the fear of a 25% downturn.

The reason why BTC price is consolidating below all time highs, why it had not reached and surpassed the all time highs again, even as BTC price consolidates underneath it for the past seven months, the reveals itself to be not that noteworthy in terms of possible significance of how significant Q2 gains will be as most of the major Bitcoin bull market gains tend to happen in the latter stage of its four year halving cycles.

Bitcoin Market Sentiment Positive

“The period March 2024 into the foreseeable future looks like scarcely more than a brief pause in a continuing trend,” he said. With that said, Brandt warned that if bearish sentiment seizes control and pushes BTC under $48,000 (around 22 percent below the current price) it could reverse his bearish outlook. He confirmed too: “Close below $48K negates my chart analysis.”

His price target lines up closely with Brandt’s but he suspects the coin could range from $125,000 to $130,000, said Material Indicators co-founder Keith Alan. He added that he is not sure about the timing.

As a whole, the market sentiment towards BTC/USD was overall positive, and numerous analysts were betting on the next macro top around 2025. As prices inch closer and closer toward an all time high, predictions for the future all time high vary wildly. Some models predict prices as high as $275,000 by the end of next year.

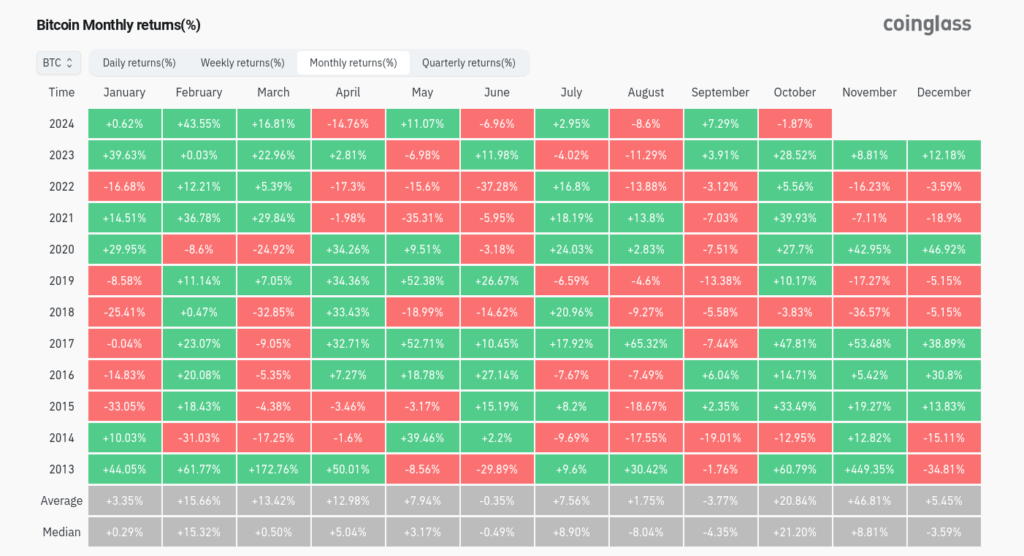

Characterizing this year’s rise to $73,800 as ’confusing’ analyst CryptoCon also predicted highs for 2025 in August. In his analysis, CryptoCon pointed out the lack of magnitude of Bitcoin’s first halving event back in November 2012. Meanwhile, predictions for new highs in September missed, even though September brought reasonable returns of around 7% last month.