Bitcoin had a strong rise on Saturday, going up above $58,250. Even though it was going up, it wasn’t able to keep going and close above the 200-day Exponential Moving Average (EMA). This caused a negative engulfing candlestick pattern to form on Sunday, which showed that prices might be moving down. Bitcoin is trading below $56,000 right now, which puts it at a very important point in terms of technical analysis and market mood.

Sina G, the COO and co-founder of 21st Capital, broke down the factors that are affecting Bitcoin’s price today, focusing on recent drops and using complex measures to show that it is currently undervalued. Starting with a look at the past, Sina said that Bitcoin had dropped 26% from its high point in March ($73,000.) It has been setting around $56,000 in recent weeks.

Several macroeconomic and sector-specific reasons have been blamed for this sharp drop. He said that the drop in Bitcoin from its high point of $73,000 in March to $56,000 is similar to dips in bull markets in the past, which usually involve big but short-lived drops.

Bitcoin German Government Sales

ETFs that invest in Bitcoin have had a huge impact. At first, these ETFs helped the price rise from $16,000 to $73,000 because investors strongly used a strategy called “buy the rumor, buy the news.” “The market went up until about the middle of March, when ETF flows were very strong. Since then, ETFs have slowed down and bankruptcy losses have taken over, which has made prices weak all the way down to $56K.

Recently, the German government’s sales of Bitcoin it took in 2013 from the pirated content site Movie2k.to have had a big effect on the price of Bitcoin. “The government’s decision to sell about 10,000 coins in three transactions happened right at the same time that prices dropped a lot on certain dates in June and July,” he said. This selling made the 24% drop in June and July even worse, which was made worse by the significant quantity of Bitcoin that came into the market.

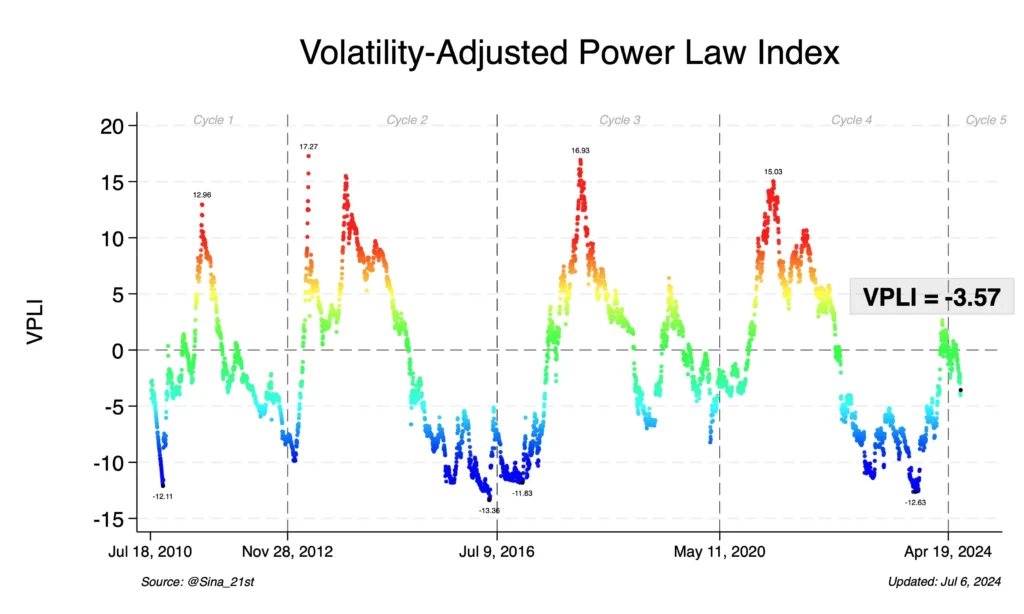

The Volatility-Adjusted Price Level Index (VPLI), a unique measure created by 21st Capital, was used by Sina to find out if Bitcoin is currently undervalued. Sina said, “Right now, our VPLI is at -3.57, which means that Bitcoin is priced much lower than it should be.” He also said that a VPLI score of -10 has traditionally been linked to the bottom of bear markets. This means that the current reading suggests BTC may be undervalued.

“This puts us in the 41%th percentile of values, which means that Bitcoin has only been below this VPLI reading 41% of the time, mostly during bear markets.” “There is a good balance between risk and reward,” he said.

Looking ahead, Sina pointed out two important short-term signs that could affect BTC price right away: how the perpetual swaps funding rate changes and whether the German government continues to sell BTC. “Recently, the funding rate has been negative, which usually means that prices are going down.” “This means that a lot of traders are selling short because they think the price will go down even more, which could mean that the market is almost at its lowest point,” he said.