Despite climbing to an all time high of $77,270 on Bitstamp yesterday, Bitcoin stood at the same price of around $76,000 on Nov. 9. Market watchers pointed to ‘spoof city’ tactics involving large, temporary orders that push price around while holding the Bitcoin’s trading range in check.

Analysts have shown cautious sentiment regarding the phenomenon.

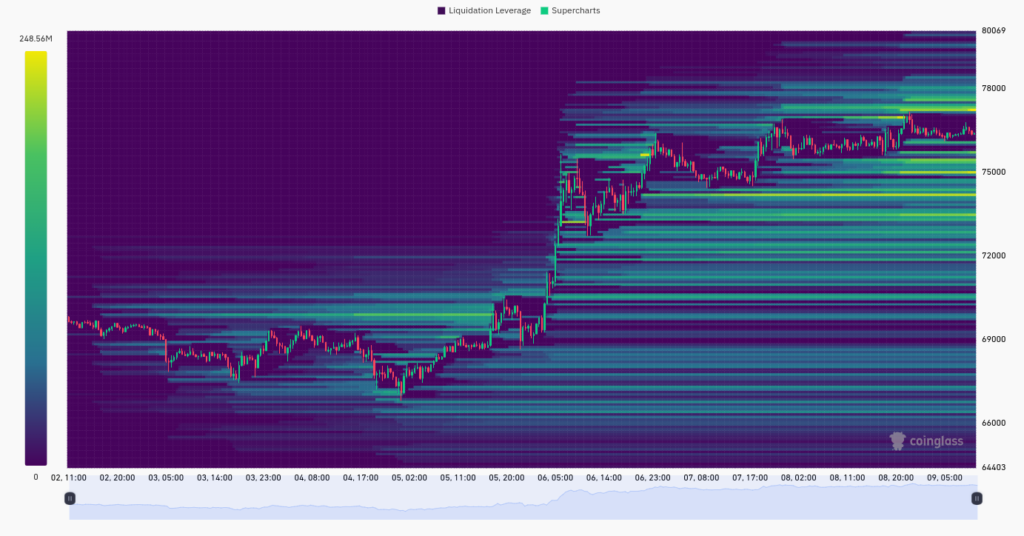

X commenters including trader Skew noticed that ‘order book’ spoofing, where major liquidity orders briefly show up before being taken off the table, was happening in crypto (which it is banned from in traditional markets). The tactic sparked speculation of the stability of recent gains.

Bitcoin Sees Whale Activity, Skepticism Rising

Data from Material Indicators says there’s significant buying activity from large investors, or ‘whales,’ on Binance who were trying to overwhelm Bitcoin price resistance on the cryptocurrency exchange. But though prices have skyrocketed recently, analysts were still skeptical. Popular commentator WhalePanda noted: ‘BTC is definitely acting weird and underperforming.’

Ahead of the week’s close, trader CrypNuevo warned of a possible ‘long squeeze’ – meaning a possible sharp price drop that would destroy recent long positions. At the same time, commentator Pentoshi remains bullish looking long term and pointed to potential demand from spot Bitcoin ETFs that reeled in $293 million in inflows on Nov. 8 after recording a record $1 billion inflow the previous day.

At the same time, Bitcoin struggles with in the volatility of its price and possible regulatory issues, analysts remain split as to its short to medium term fate, though bullish sentiment continues on the long term.