For those who follow Bitcoin, a key indicator of the on-chain activity has broken free from a three-month declining trend, suggesting a possible increase in market momentum in a major change of events.

In a recent update on X (previously Twitter), crypto expert Ali Martinez claims that daily active Bitcoin addresses have witnessed a considerable increase, therefore triggering a decline starting on March 5. Martinez underlined that shockingly 756,480 Bitcoin addresses have been actively involved throughout the last 24 hours. Martinez says characterizing this change as a “positive sign” could indicate Bitcoin’s upward trend’s continuation.

Strong Bitcoin Taker Ratio Bullish

This comeback in on-chain activity could indicate a comeback in user involvement within the Bitcoin ecosystem, a component that typically links with increasing price swings. Furthermore, the current increase in daily active addresses fits a rising list of positive signals for Bitcoin.

The declining availability of BTC on exchanges, which lately reaches new lows, adds to the hopeful attitude. This pattern suggests that rather than making quick sales, investors are increasingly inclined to hang onto their BTC holdings for the long run. Martinez underlined this trend by reporting a withdrawal of over 22,647 BTC ($1.57 billion) from crypto exchanges in the preceding week alone.

The outstanding BTC Taker Buy Sell Ratio on the HTX cryptocurrency exchange—which right now stands at 730—helps to build confidence even more. With Martinez reading this jump as a possible forerunner of a significant upward trend in BTC price, it points to a clear increase in accumulation.

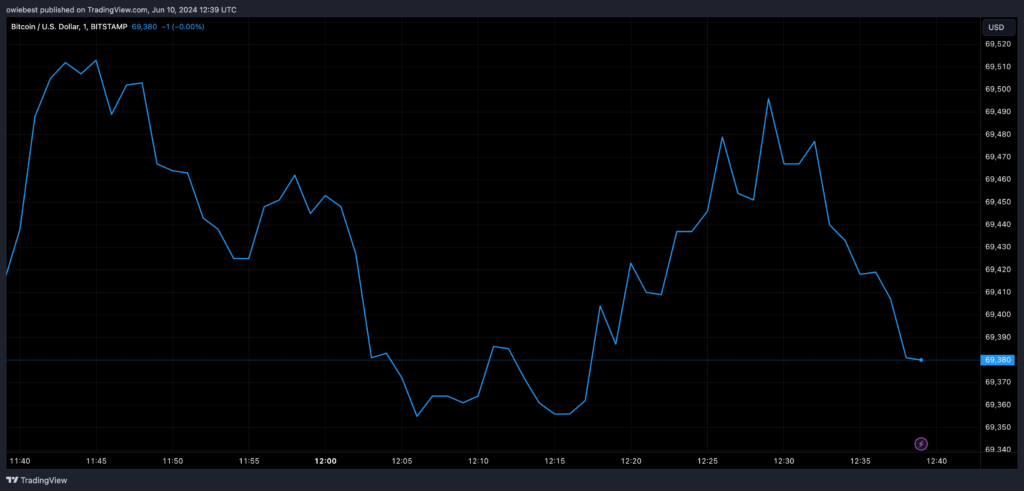

Martinez underlined a vital zone between $69,380 and $67,350 where a lot of addresses have bought considerable sums of BTC, thereby shedding light on the present support levels of the BTC. Maintaining above this level, Martinez advises, is absolutely essential for preserving the upward momentum of BTC.

Anticipating the next local top of BTC, Martinez predicted on the possible peak of the currency at $89,200. But more general market mood, as reflected by analysts like Tarekonchain, shows Bitcoin’s ultimate climb above $100,000 before attaining its market top.