Nowadays, Ethereum (ETH) is valued far less than it once was. It lost basically 4% on September 7; thus far this month it has dropped 10%. Though its gains for 2024 have decreased by 42% in the past four months, rendering the currency red for the year thus far, it is the second most valuable coin by market value.

Problems with the coin and overall market trends are among the several causes behind the current declining ETH price. On September 6, 142,000 persons were hired by non-farm businesses in the United States.

164,000 expected it would be greater than this. This was evident from the September 6 fall in the crypto market overall. People’s even less hopeful about the economy since the news on jobs did not reflect what they expected. This influences both real-world events and digital ones.

Ethereum ETFs Contribute To Recent Price Decline

First week of September left Ether exchange-traded funds (ETFs) with a sizable sum left. This is a major factor behind current declining Ethereum prices. Many are selling, and Grayscale Ethereum Trust is mostly responsible for this. Spot ETFs lost $111 million. Most money was taken out of the $52.3 million and $4.06 million remained in the account on September 3 and 4.

Though not much, Ether ETFs have been receiving some funds. Fidelity recorded $4.9 million in incoming on September 3; Blackrock recorded $4.7 million on September 7.

This increase in institutional demand has several asset managers reviewing their Ethereum products once more. limited performance, limited liquidity, and low investor interest caused VanEck to halt their ETH futures ETF; WisdomTree recently withdrew its register for the ETH Trust S-1.

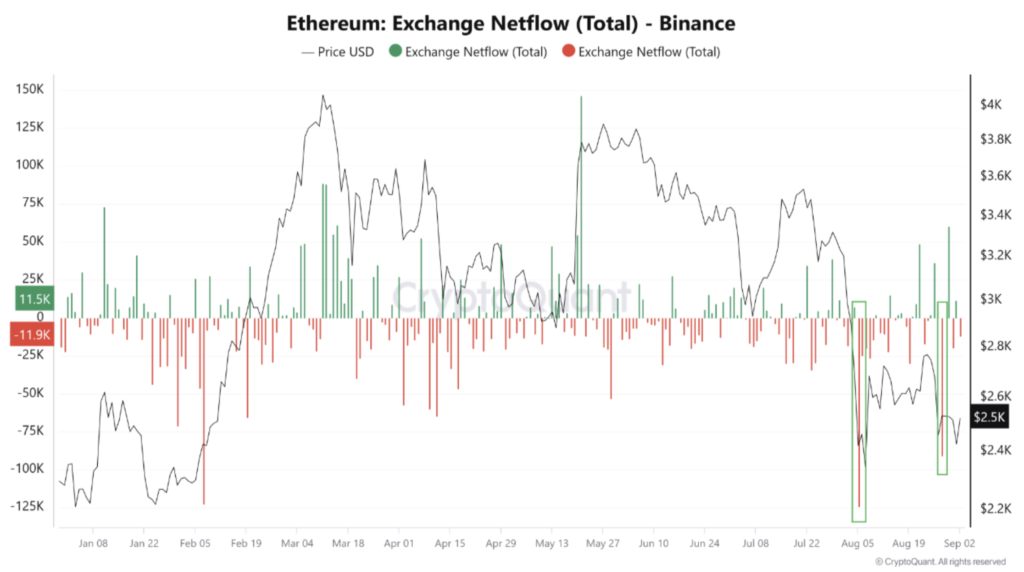

Ethereum has issues that go beyond institutional purchasers; ordinary individuals have not been buying it either. The fact that $856 million departed centralized ETH exchanges in the past thirty days indicates that consistent buyers are not interested in it. Since September 1, when the financing rate began to progressively drop, open interest (OI) has increased by 12%.

Ethereum prospective buyers have thus been losing money. Open interest is rising while prices are declining implies that traders are shorting Ethereum actively in case the price declines much more.

The open interest level is somewhat similar to what it was on August 27, when ETH’s price was roughly $2,000. Apart from declining financing rates, OI’s negative correlation with price most certainly helps to explain Ethereum’s current declining trend.

The declining market liquidity of Ethereum also influences its performance. A research by CCData published in August shows that the 5% market depth on ETH trading pairs has declined significantly from its June 2024 peak. Looking at buy and sell orders within 5% of the mid-market price allows one to gauge liquidity by use of the 5% market depth. More depth denotes less error and more liquidity.

With the introduction of spot ETFs, Ethereum was supposed to gain from more liquidity; but, this has not happened. Since the fall in market depth lowers consumer interest and trade volumes, Ethereum finds it more difficult to get hopeful impetus.

Ethereum is having such many issues, thus we do not believe it will be able to improve quickly. Institutional withdrawals, a negative outlook of the future, and insufficient money in the market account for the present decline.

If Ethereum is to flourish, more people to trade on it and consistent people to pay attention to it depend on. Given the state of the market, Bitcoin might still be in demand till then.Although prices are declining, the rise in open interest indicates that traders are aggressively shorting Ethereum in should the price drop considerably further.

The open interest level is somewhat similar to it on August 27, when ETH’s price was roughly $2,000. Apart from declining loan interest rates, OI’s negative association with price most likely explains Ethereum’s declining trend.

Drying of the market is another factor slowing Ethereum’s expansion. According to their August research, the 5% market depth on ETH trade pairings has dropped significantly since June 2024, when it was highest. Examining buy and sell orders within 5% of the mid-market price reveals the 5% market depth.