The second-largest digital currency in the world, Ethereum (ETH), has seen significant sell-offs by both major holders (whales) and institutional investors. The significant drop in its price has caused concern among dealers and investors.

Recent disclosures, posted on X , showed that Asian trading hours saw a significant 55,035 ETH offloaded to Binance valued at $123 million. Two main participants in this extensive sell-off were digital asset management business Metalpha and algorithmic trading startup Wintermute.

Metalpha gave 8,088.8 ETH valued at $18.05 million; Wintermute dumped 46,947 ETH valued at $104.74 million. This significant sell-off, which lasts just two hours, could influence Ethereum’s price even further. There have probably been several elements causing this sell-off.

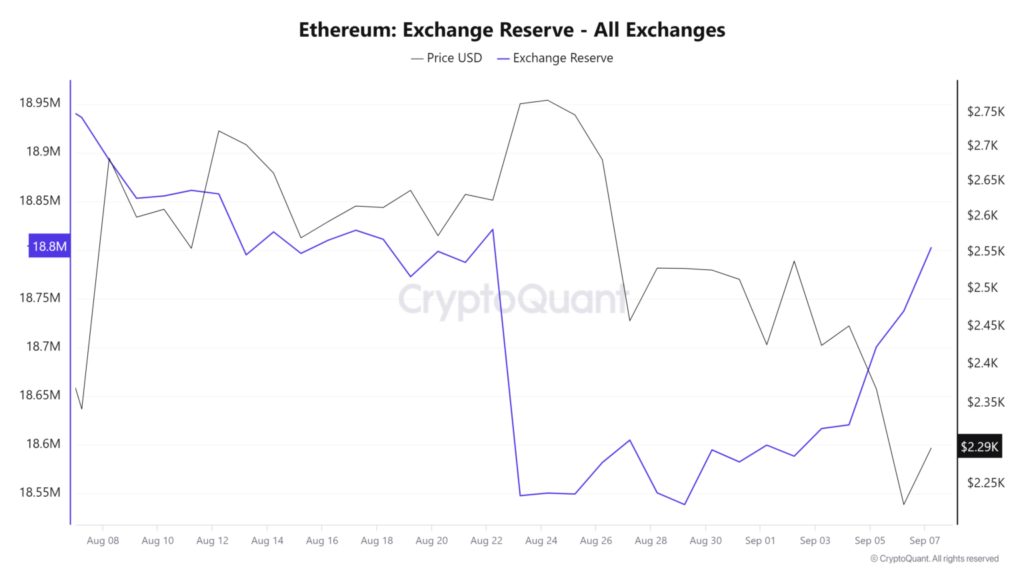

Ethereum Reserves Rising

First, as the general pessimistic attitude in the market has remained, Ethereum’s exchange reserves have grown. Since August 28, ETH exchange reserves have been progressively increasing, according to on-chain data provider CryptoQuant, implying that whales, institutions, or other investors might be ready for more sell-offs.

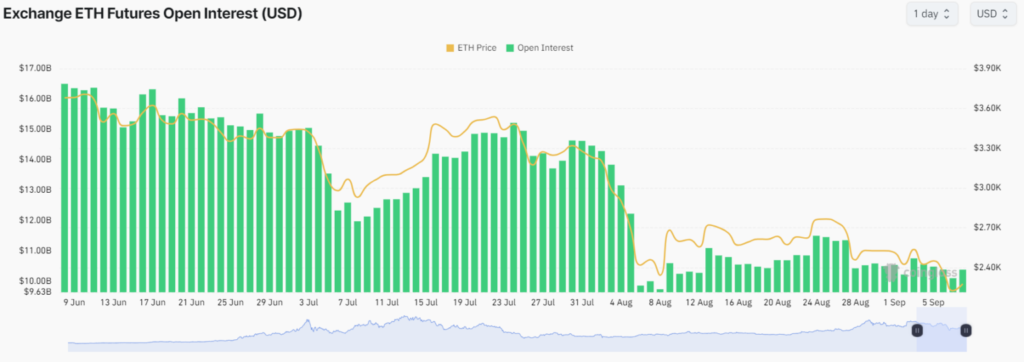

Ethereum’s Futures Open Interest has been declining for three consecutive months, indicating a lack of new opportunities. According to CoinGlass data, Ethereum Futures Open Interest has been declining, either due to long position liquidation or future contract expiry. This is sometimes an indication of a declining market mood.

Traditionally, September has been a difficult month for cryptocurrencies because of price adjustments. Still, some analysts think October might see a more intense comeback. Technically, Ethereum just retested its important support level of $2,140, which has been a solid support zone since late 2023.

Furthermore, the daily chart’s Relative Strength Index (RSI) for ETH shows a positive divergence, which usually points to a possible trend reversal. If this is the case, ETH’s price could increase by 25% to 30%, potentially reaching $2,500 or $2,550.

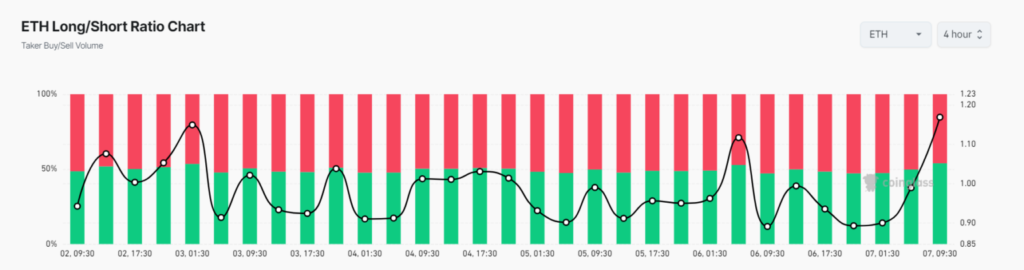

Additionally, shorter-term signals for Ethereum look promising. With an ETH Long/Short ratio of 1.168 for the four-hour period, CoinGlass claims the market was in a bullish mood. A ratio higher than one indicates that traders are expecting the price to grow and are leaning toward long holdings.

Data also showed that although 46.12% of top traders held short positions, 53.88% maintained long positions. Furthermore, Ethereum’s trading volume jumped almost 100% over the past 24 hours, indicating more traders’ and investors’ involvement.

Though its price dropped 2% to $2,280 at the time of writing, the increased trading volume would imply fresh interest in the asset as it approaches its support level.