The price of Ethereum (ETH), went down a lot last week, causing the cryptocurrency market to crash as a whole. Many buyers lost faith in ETH as the market went down. Recent events, on the other hand, point to a possible turn of events for the coin.

CoinMarketCap says that in just seven days, ETH’s price dropped by more than 12%. According to data from IntoTheBlock, the average amount of people who own ETH went down, which is a reflection of the sharp drop in price.

During this downturn, Lookonchain shared about a significant move by Ethereum “whales” who sent more than $82.2 million worth of ETH to Binance. The price drop happened at the same time as this major sell-off.

Ethereum Market Value Tops $356 Billion

The daily chart for ETH showed signs of rebound, even though these signals were negative. In the last 24 hours, the altcoin has gained nearly 3%. ETH was worth more than $356 billion on the market at the time of this writing, selling at $2,967.81. But the trade volume dropped by more than 10%, which suggests that the bullish trend might not last long.

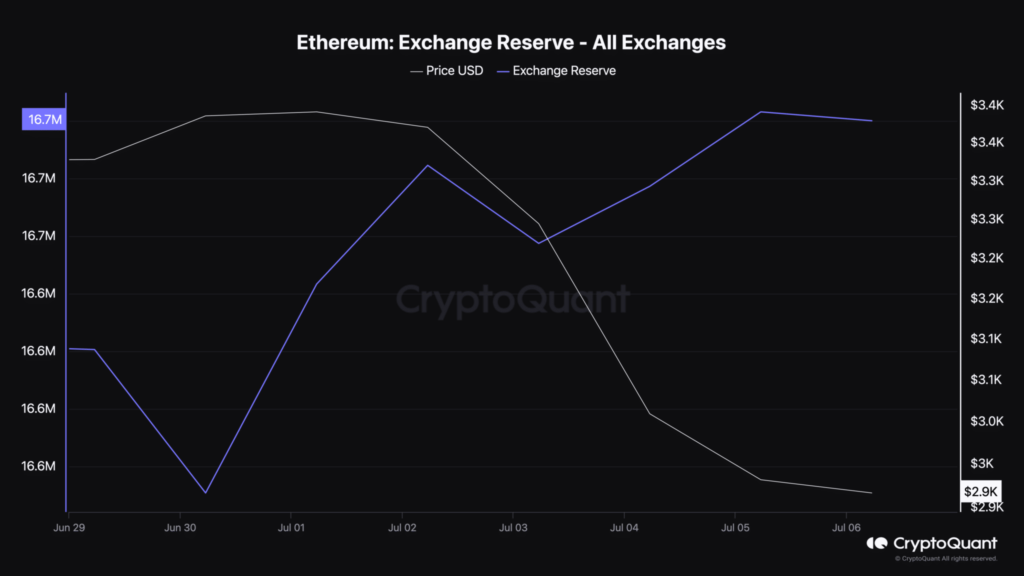

Several indicators pointed to this cautious view. CryptoQuant’s data showed that ETH’s exchange reserves went up, which suggests that people are still trying to sell. Still, other signs pointed to a possible rise.

The fact that the funding rate for ETH was going up showed that long-position traders were in charge and ready to pay short-position traders. CryptoQuant also said that ETH’s Relative Strength Index (RSI) was in the low area. This could make more people want to buy, which could cause the price to go up.

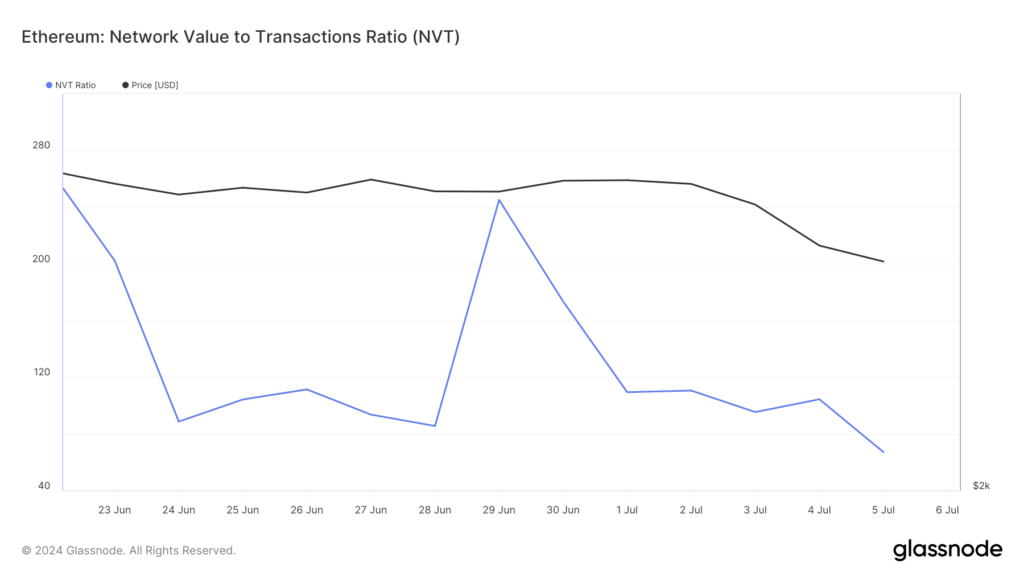

After more research, more good signs were found. According to Glassnode’s data, Ethereum’s NVT ratio dropped sharply. This suggests that ETH is cheap, which is often a sign that prices will go up. The price of ETH hit the lower end of the Bollinger Bands on the daily chart, which suggests a possible bounce.

The Money Flow Index (MFI) was also getting close to the oversold area, which means there might be chances to buy.On the other hand, not all signs were positive. At press time, the Chaikin Money Flow (CMF) had a negative value of -0.09, which means people should be careful.