According to reports, Singapore Gulf Bank is looking to raise an additional $50 million to fund a purchase of a stablecoin payments firm by early 2025.

But the bank, which has been vocal in its crypto-friendly stance, is also willing to sell up to 10% of its equity to raise the necessary capital, Bloomberg reported on Nov. 25, quoting sources familiar with the matter. The acquisition, banks said, will bolster its digital payment network and add more talent to its bank.

There have been talks with a Middle East sovereign wealth fund and other possible investors. A Whampoa Group-run bank declined to confirm the report, but a spokesperson said the bank would not discuss strategic initiatives.

Singapore Gulf Bank Eyes Stablecoin Deals By 2025

Last month, a Singapore-based family office known as Whampoa Group obtained an operational license in Bahrain, indicating the group’s regional expansion. According to reports, Singapore Gulf Bank is looking to acquire stablecoin payment firms in the Middle East or Europe, and has pencilled in the first quarter of 2025 as the timeline.

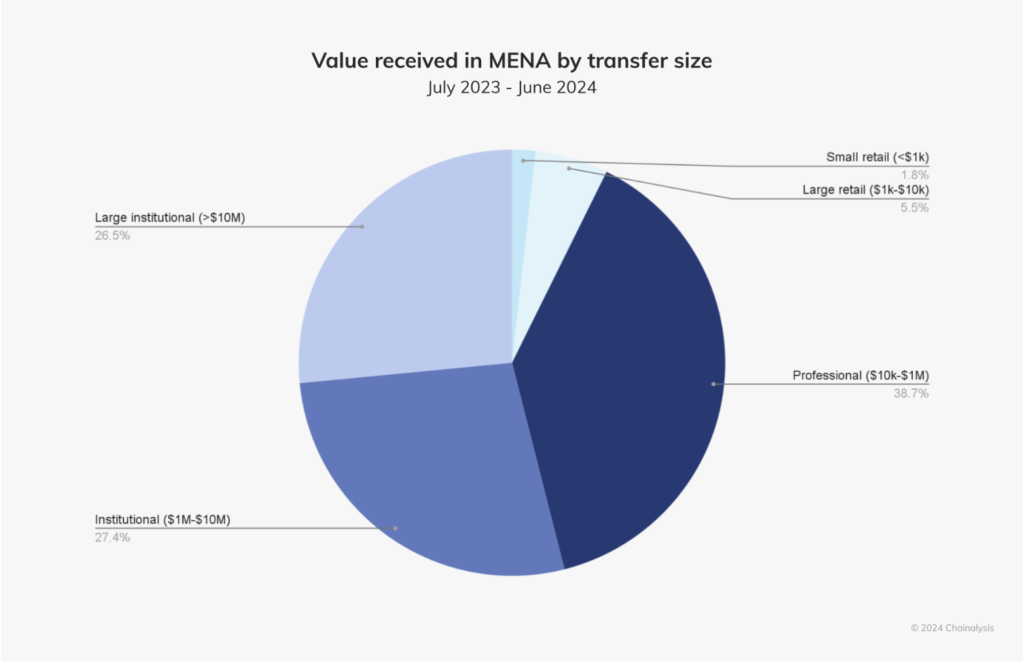

Aligning with spiking Web3 activity in the Middle East from Bahrain, Dubai and Abu Dhabi, the move comes. Chainalysis is quoted by the September report as saying the region of the Middle East and north Africa (MENA) is now responsible for 7.5 percent of the world’s cryptocurrency transactions, especially from large institutions in the sector.

The report highlighted the fact that the United Arab Emirates and Saudi Arabia have increasing interest in decentralized platforms. The UAE’s Central Bank also recently introduced a custodial insurance product to indemnify financial institutions and clients from losses from cyberattacks, fraud and the like.

Singapore Gulf Bank’s steps are part of a wider effort to tap into the accelerating crypto and stablecoin space in the MENA region, as investors continuously drive interest and the environment for supportive regulation continues to improve.