Washington, D.C., Jan 9 Stablecoin issuer Circle has donated $1 million worth of USDC to President-elect Donald Trump’s Inauguration Committee, CEO Jeremy Allaire said in a statement January 9. On the move, the stablecoin industry takes a major step forward, with the asset class making a place for itself in the political and regulatory worlds.

Accepting the donation from the Inauguration Committee was all in part experiencing the maturation of digital assets, said Allaire. Allaire said this shows how far the industry has come in being regarded as a legitimate financial force.

Stablecoin issuers hold $120 billion U.S. Treasuries

The cryptocurrency sector is optimistic of pro-crypto legislation under Trump’s administration, and he assumes office on January 20. Regulatory reform could lead to innovation and growth in blockchain technologies, industry leaders anticipate.

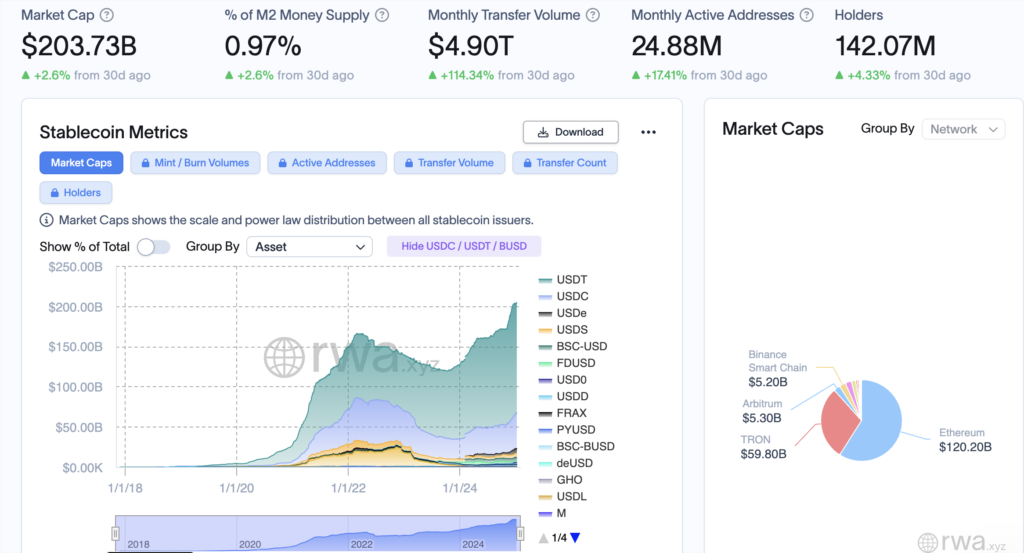

The $203 billion stablecoin market is a substantial eight percent of U.S. financial policy conversation. That total equates to $44 billion for USDC, which is no small figure.

Policymakers increasingly show interest in stablecoins. In April 2024, Senators Kirsten Gillibrand and Cynthia Lummis cosponsored the Lummis-Gillibrand Payment Stablecoin Act to set out a regulatory framework for the asset class.

When introducing the bill, Senator Gillibrand said that passing a regulatory framework for stablecoins is absolutely critical to maintaining a dominance in the use of US dollars.

In June, former speaker of the House Paul Ryan called to use stablecoins to help the national debt crisis and strengthen the U.S. dollar’s status as a global reserve currency. In October, before launching his presidential run, Senator Bill Hagerty introduced the Clarity for Payment Stablecoins Act, a state-level regulation proposal for lower market capitalization issuers ($10 billion), intended to strike a balance in oversight.

According to people familiar with the matter, stablecoins have an important role in the U.S. economy, including as a holder of U.S. government debt. Collectively, these overcollateralized stablecoin issuing companies hold over $120 billion in short-term U.S. Treasury securities, making them the 18th largest owner of government debt globally.

The mere existence of TEs has prompted discussions concerning their role in the financial system, as some of the more prominent policymakers have suggested that they might enable a stabilization of fiscal policies and reinforce the dollar’s confidence in the international financial system.

The stablecoin market topped industry leaders’ forecasts to see rapid growth. Ethena founder Guy Young sees the space reaching $300 billion in market capitalization by 2025 due to incumbents such as Tether and Circle.

According to Deng Chao, CEO of HashKey Capital, stablecoins are attracting in increasing numbers from venture capitalists in emerging economies and beyond. “Stablecoins offer vital banking services to the world’s unbanked populace and are among the most exciting digital asset classes for investment,” said Chao.

Creating stablecoins is quickly becoming one of the faster ways to invest in the cryptocurrency industry as pro-crypto sentiment builds and legislative frameworks come into the picture. The high-profile donation by Circle shows that digital assets are no longer outcast crypto innovations but central parts of the financial regime.